Inflation continues to stand between Bank of England (BOE) and its first rate hike after the 2008/09 crisis. Today's data showed, despite rising wages, growing GDP and improvement in retail sales, not only head line inflation but core remains weak too.

Since Bank of England officials made it clear that they aren't going to chase lower oil price with more stimulus it has got nothing much to do but sit tight and pray for inflation return towards normal.

- After growing 0.1% in May on yearly basis, Headline inflation (CPI) dropped to zero. Surprisingly core inflation dropped to 0.8% in June from 0.9% in May.

- House price (HPI) rise remains subdued, with prices growing by 5.7% from a year ago.

- Only piece of good news is retail price index (RPI), which rose by 0.2% in June on monthly basis, up 1% from a year ago.

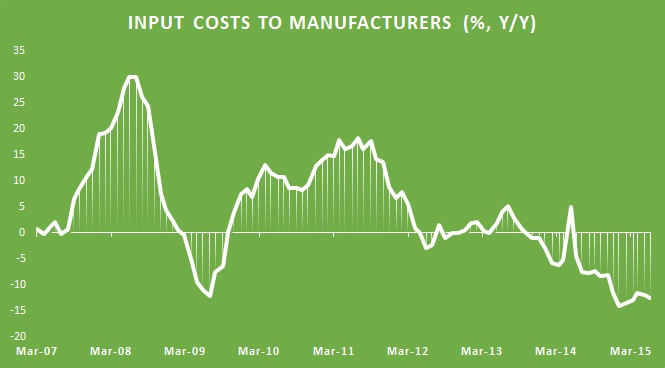

So what might be pushing prices lower?

- The answer to the puzzle lies in another inflationary measure, which is producer price index.

- Input costs for producers' dropped by another 1.3% in June from May. Yearly figure shows how depressed it is, dropping at -12.6%.

- To stay attractive and competitive, producers are passing on this lower cost to consumers. Discounts are all evident in stores across the country.

While commodity prices remains low, fuelling disinflationary pressure across country, BOE shouldn't be too worried on that.

In the meantime, let us hope, people of UK won't get too used to lower prices and discounted sales.

Pound is relatively stable, in spite of lower inflation, trading at 1.548 against dollar.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand