Delta signifies the equivalent FX spot outrights of a given position. This is the sensitivity of a position's value with respect to the spot rate.

This is useful to monitor directional risks so you may know how much your option's value will increase or diminish as the underlying market moves.

A higher delta value is desirable for an option holder, whilst a delta close to zero is desirable for the option writer; a buyer wants their option to become more valuable whilst a seller wants the option to become less valuable.

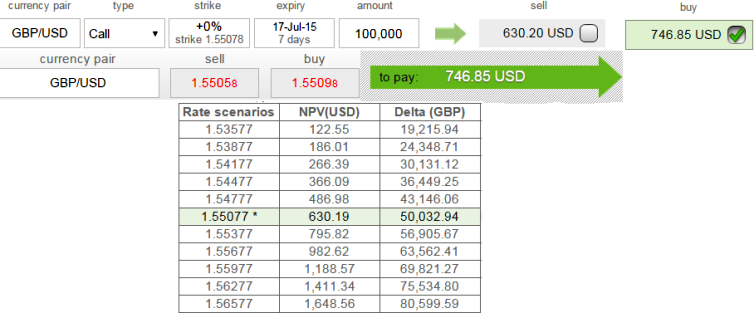

For an instance, as we can see in the chart that overall position in GBPUSD behaves as if it was long 50,032.94 GBPUSD spot.

But in real terms, if at all GBPUSD spot were to move up by one pip then the relative sensitivity in option premium would be USD 0.5003. To hedge a call, one would invest the option price proceeds into Δt∗St+Bt=ct (where Δ=delta).

These terms may seem quite strange to you but nothing rocket science hidden in it, we would run you through these blackscholes in upcoming articles.

Why delta is crucial in option strategy

Friday, July 10, 2015 1:59 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings