The crude oil markets are crucial to pay attention to if you are going to trade any financial asset, as crude oil is considered to be the “lifeblood of the economy.” This is because as crude oil consumption increases, it suggests that there is significant economic activity, as more transportation will be needed to push goods back and forth between destinations around the world. Conversely, if crude oil consumption drops, it stands to reason that there are much fewer goods being moved around, signaling a slowing economy.

As far as the price is concerned, if there is more demand for crude oil, all things being equal, the price should continue to go higher. However, if we are starting to see less demand for energy, then the price should drop. The bulk of demand for crude oil comes from automobiles and aircraft. Depending on the market that you are trading, you may also pay attention to trucking companies and similar industries to give you an idea as to whether or not demand is shrinking or increasing. However, as a foreign exchange trade, you should try to simplify the analysis.

Let the oil traders determine the price

One of the biggest mistakes that newer Forex traders often make is to overanalyze things. Typically, it can come in the form of several technical indicators on a chart, which of course leads to “paralysis by analysis.” However, there are also traders who put way too much effort into fundamental analysis, which can have the same effect.

In this sense, as a currency trader you need to trust the oil traders to determine the price of that commodity, and whether or not demand is rising or falling. There are major trading firms out there with dozens of analysts that are weighing up the economic reality of the oil markets. They spend millions of dollars and thousands of man-hours trying to figure out this scenario, so you are better off letting them do the hard work.

Correlations between crude oil and currencies

Remember, your job as a foreign exchange trader is to figure out where supply and demand is when it comes to currencies. It is to try and understand the underlying drivers of the currency. When it comes to crude oil, there are a handful of major exporters that you can pay attention to when it comes to the effect of oil demand or supply. One prime example is Canada, as it is a major exporter of crude oil. The theory of course is that when crude oil demand is rising, there will be more demand for Canadian dollars as those Canadian drillers need to be paid in the local currency. This is why a lot of traders will use the USD/CAD currency pair as a proxy for the oil price, at least from a historical sense. However, as the U.S. is a major oil producer these days, it makes more sense to find an economy that desperately needs crude oil, as it cannot produce its own. In this case, that perfect economy is Japan. The Japanese import 100% of their petroleum, so it makes sense that Japanese companies will be buying Canadian oil, thereby sending the CAD/JPY pair higher when there is demand for oil and of course vice versa.

Take a look at the chart below: It is the Canadian dollar against the Japanese yen drawn out as a red line, compared to the WTI Crude Oil market drawn out as a black line. This is on the weekly timeframe, so it shows that over time, this pair tends to fall and rise right along with crude oil.

While it is not necessarily a one-to-one relationship, it does show that the longer-term trend does correlate quite nicely. This is matching up supply and demand when it comes to cross-border transactions.

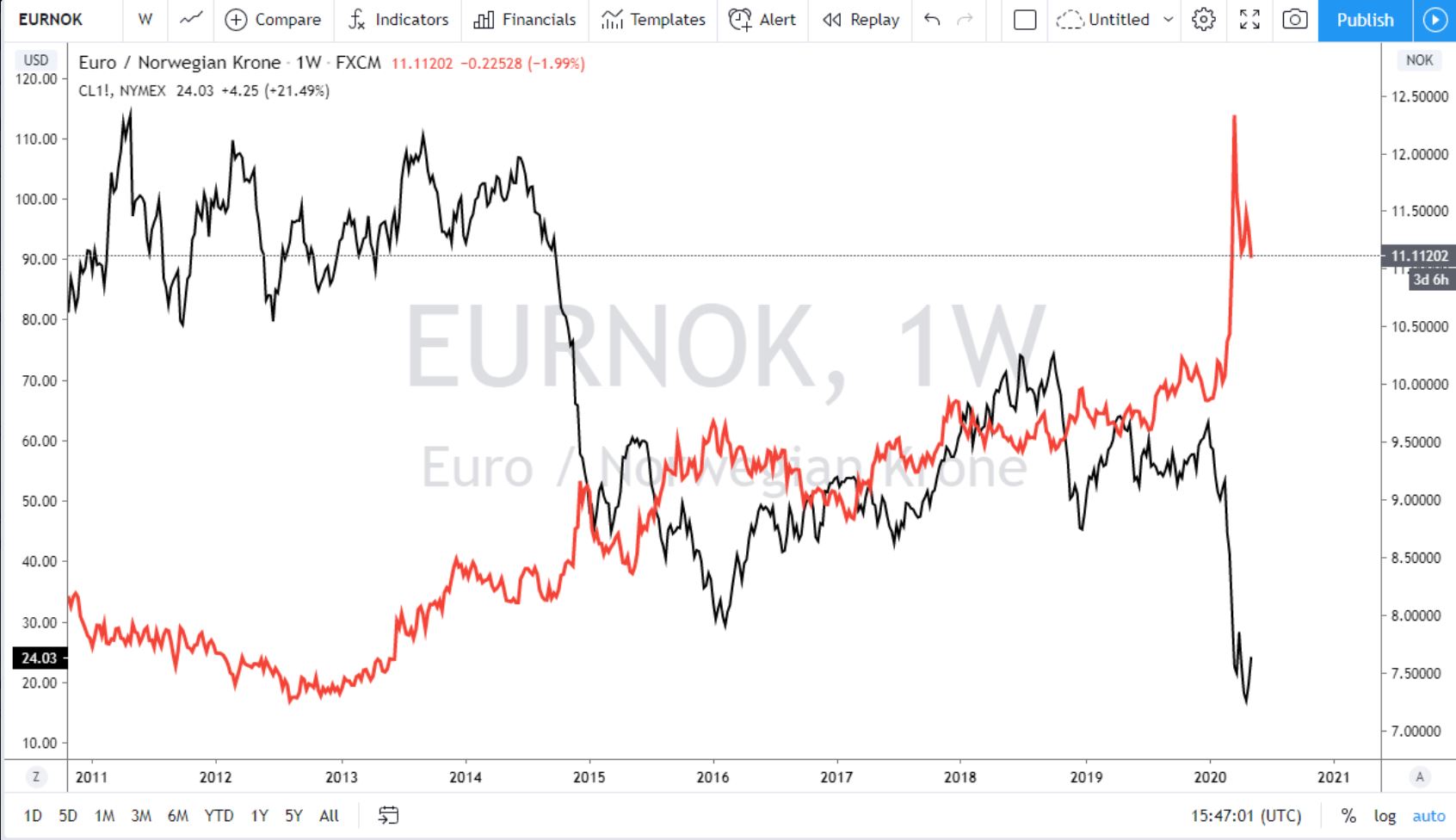

There are other currencies that you can look at as well, for example the Norwegian krone. Norway is a major exporter of crude oil, so the same correlation can show itself there as well. Notice on the chart below, the Euro spike higher against the Norwegian krone as oil prices collapsed towards the $20 level. This shows a clear lack of demand for the major export of Norway, and therefore the currency itself was not in demand.

The main takeaway

The main takeaway is that as a Forex trader you need to be lined up with international currency flows. With that being the case, you can see above that the crude oil market has a significant effect on specific currencies. Furthermore, when looking at a commodity for a signal for trading currencies, you are better off trading a crude-oil related currency against a currency of a country that produces little or no oil.

For what it is worth, you can also use crude oil to give you an idea on how the global economy is performing, which of course helps with the overall risk analysis of various currencies. While it may not produce a particular signal, it can tell you whether or not you are moving with the overall sentiment for the longer-term trend.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch