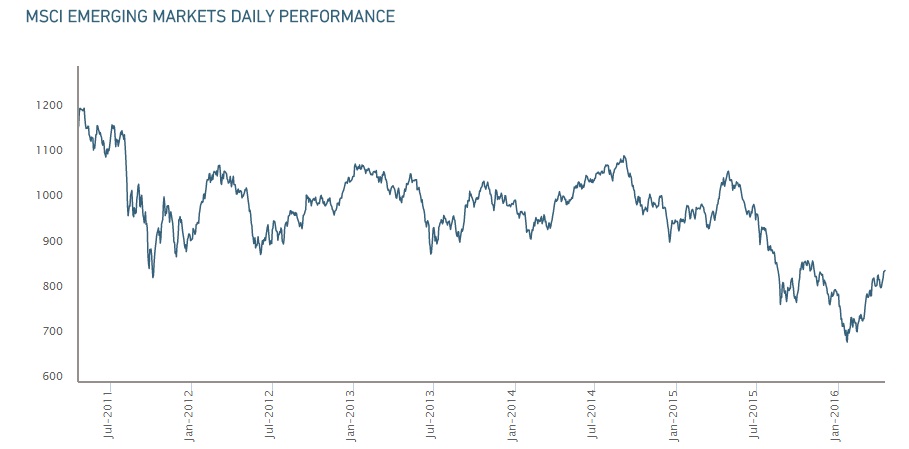

After dismal performance through 2015, emerging market assets, are having their best time in years. MSCI emerging market index has rallied 23% since late January and with new found optimism in global financial markets it is likely to move higher.

MSCI emerging market gives 23.89% weightage to China, 8.1% to India, 6.58% to Brazil, 3.75% to Russia and 57.69% to 19 other markets Asia, Europe, Middle East, Africa and Latin America.

If the optimism lasts, Emerging markets are likely to outperform their developed market peers as assets are still oversold by many measures, cheaper pricing make them attractive and lower exchange rates make them even cheaper.

According to Bank of America Merrill Lynch’s (BofAML) global fund mangers’ survey, positioning in emerging market, compared to history is worst, only second to energy sector. At the trough of emerging market assets, beginning 2016, net 30% fund managers were underweight the EM, now only little more than 5% are underweight EM, which means, still significant amount of money can flow to EM assets, leading them higher.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX