Is the panic surrounding Chinese stock market, economic weakness and currency, all over?

Could be, at least for now.

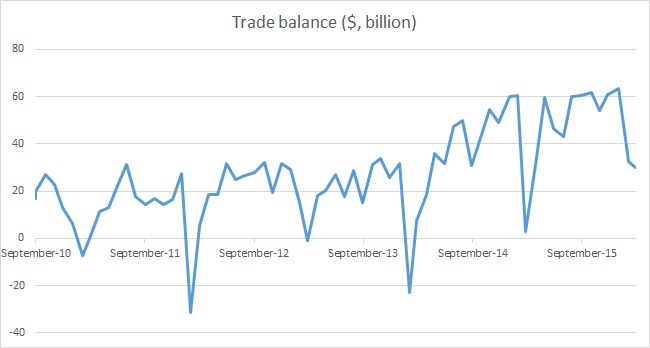

Today’s trade data saw Chinese trade balance still positive but very weak compared to history, even if it was almost in line with median expectations. March’s report showed, Dollar denominated export figure rose 11.5% from a year ago, which is encouraging since

- It is the best figure a year.

- It is first positive number, since last June.

Moreover it is the seasonality and Dollar effect.

In Yuan term, Trade balance came at Yuan 194.6 billion, better than expected. To add to that, seasonality. Traditionally and historically, March has been weakest month of the year in Chinese trade, possibly due to rebalancing at financial year end. Sometimes, trade data has been in negative in March, line in 2014. In that context, trade balance figure, with increased exports were very encouraging.

On monthly basis exports jumped 27%, while imports were up 40%, another encouraging figure.

Country level break down has also been encouraging.

- Exports to China’s biggest trading partner U.S., rose by 9% y/y in March.

- Rose 17.9% y/y for European Union, 14.8% for ASEAN and 9.3% for Japan.

With such relatively brighter data, it is difficult to spark panic and risk aversion, however if the trade balance fails to improve from here, then there could be panic.

China’s benchmark stock index is up 2.1% today, while Yuan is trading at 6.463 per Dollar.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX