Fears that Chinese growth is weakening, dragging the global economy with it, are hammering commodities and world stock markets. Global stock markets extended broad based sell-off, with Chinese equities rout exacerbating the pain along with plummeting oil prices. Asian stocks slumped to 3-year lows on Monday.

"Markets are panicking. Things are starting look like the Asian financial crisis in the late 1990s. Speculators are selling assets that seem the most vulnerable," said Takako Masai, the head of research at Shinsei Bank in Tokyo.

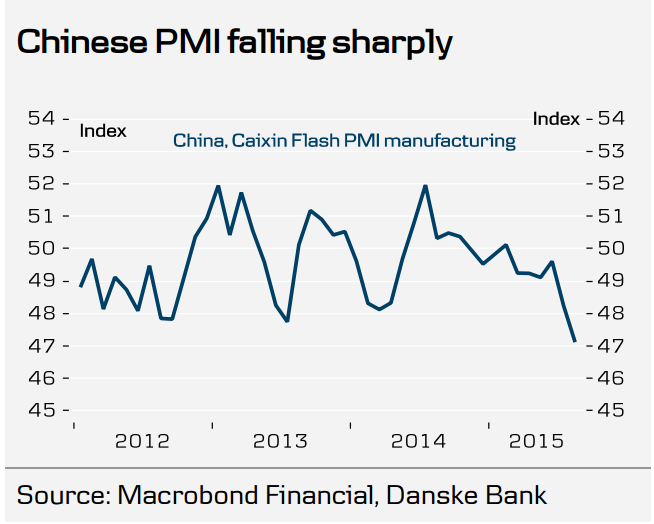

Chinese PMI went from bad to worse in August, down from 48.2 to 47.1, the lowest level since 2009, showing a clear deterioration in the economy. It highlights the risk that the negative effects of the equity market plunge have been underestimated and companies and consumers are hitting the brakes.

Developments in China will continue to demand attention this week. Markets will be watching for China's next move as signs of a slowdown in the world's second-largest economy stack up, raising expectations that the PBoC will act to stoke growth.

"It will be all eyes on the Chinese authorities for any further policy support steps, alongside the People's Bank of China yuan fixings and trading swings," analysts at Investec Economics said in a note to clients.

Further interest rate cuts and a reduction in the reserve requirement ratio are the likely response. A challenge for the PboC is that the intervention to keep the CNY from depreciating too much has put upward pressure on money-market rates. For this reason we believe the PBoC is likely to cut reserve requirement ratio soon.

"We continue to look for one benchmark rate cut of 25bp in Q3 and one to two RRR cuts of 50bp each in H2 2015, depending on liquidity conditions. These should support the real estate sector and growth stabilisation," Barclays said in a note to clients.

China's yuan weakened against the dollar on Monday. Spot market CNY opened at 6.3897 per dollar and was changing hands at 6.3978 at midday, off an intraday low of 6.3994 but was still 0.14 percent weaker than the previous close. Offshore yuan CNH was trading 1.04 percent down from the onshore spot at 6.4648 per dollar.

Weak Chinese data adds pressure on PBoC, policy easing moves look highly likely this week

Monday, August 24, 2015 10:18 AM UTC

Editor's Picks

- Market Data

Most Popular

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom