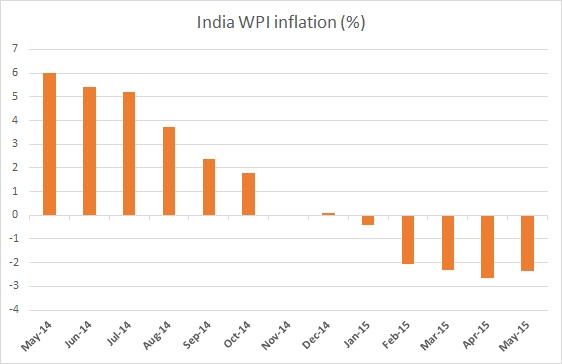

Just a few weeks back Reserve Bank of India's governor Raghu Ram Rajan has cut rates for third time this year, however continued deflation as measured by India's wholesale price index (WPI) unlikely to make him jump the gun for fourth time any time soon.

- India's WPI inflation remained in deflationary territory for five consecutive months. Whole sale prices deflated by -2.36% in May after -2.65% in April. Detailed report shows that price drop in energy segment including power by -10.5% offset the impact of food inflation, which stands at 3.8%.

Reserve Bank of India (RBI) likely to exercise caution as Monsoon this year remains a concern in India. Lower than expected monsoon might lead to spike in inflation especially in the food and cereal segment.

Moreover FED's rate hike is likely to keep RBI on his guard. However over the longer horizon, more than six months, RBI is likely to ease further if inflation remains sable.

RBI's strategy to tackle FED decision -

- INR has failed to appreciate much, in spite of investor optimism and foreign inflows. In fact this year it has depreciated 1.7% against dollar. That is partially because RBI is buying dollars from the market, which is keeping the INR mostly stable against key pairs. RBI is building up its coffer pretty fast in the process. India's forex reserve now stands at $352 billion. This much reserve stands highest in RBI's record. INRis currently trading at 64.1 against dollar.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?