After two years of sharp slowdown and currency market adjustment, question arises hasn't the market priced in China weakness already.

- What I mean is, Chinese economy has slowed down to 7% from double digit growth just few years back and it is expected to continue to slow down in the foreseeable future.

- Given such fundamentals, Commodities have fallen sharply, say Copper, which is key barometer for global growth is down more than 25% in last 1 year, Oil is down close to 50% for the same period.

- Same can be said about currencies, Brazilian Real is down close to 50% this year so far, while Aussie corrected about 25% in last one year.

So the question naturally comes, hasn't the market priced in the weakness in China.

Partially Yes but fully...my guess is No. World is not prepared for a hard landing in China. Glimpse of that we have seen in recent financial market turmoil.

If such turmoil might happen over just about 2% Yuan devaluation, a hard landing might cause serious damage.

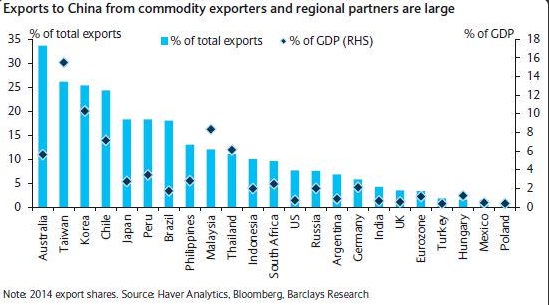

The chart from Barclays research shows, some countries have additional vulnerability to China's hard landing, given their still high exposure to China via exports to the country.

- 35% of the Australia's total exports head to China, which contributes about more than 6% of GDP.

- It is even more critical for Korea, about 1/4th of total exports heads to China, equivalent to 12% of GDP.

- Even for Japan, 20% of exports head to China.

- Euro Zone has relatively low exposure to China's imports, just about 2% of total exports head to China. See the chart for further details.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary