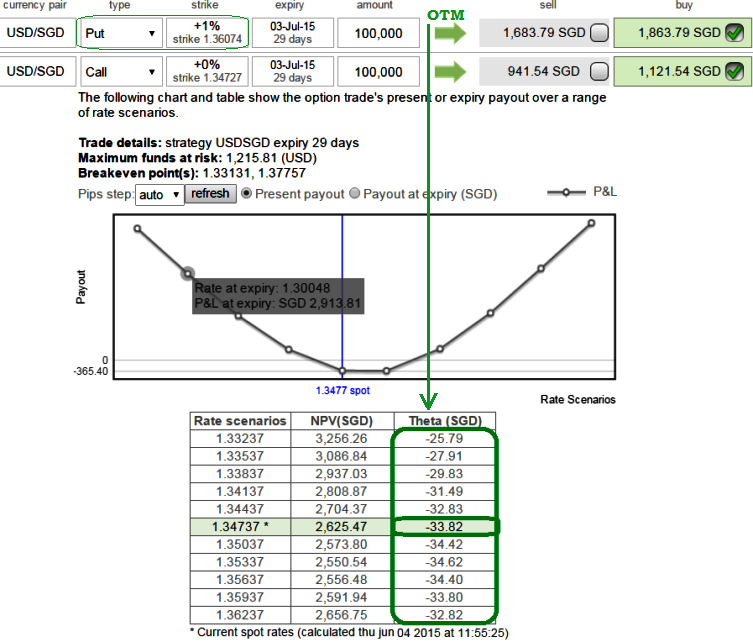

Buy 1M USD/SGD OTM Put and simultaneously buy ATM Call option = Strike on 1.3475 + Strike on Put 1.3608.

We advocate this strategy as Theta on combined position is signifying time decay advantage of this pair as shown in the diagram.

We are recommending this with a view of neutral direction to slightly downward momentum in this pair.

Even though it is usually the simultaneous buying of an ITM call option and an ITM put option, we traced out OTM put in this position on account of negative theta numbers.

As shown in the nutshell, there is no significant change in theta value even though the underlying exchange rate oscillates dramatically. From spot 1.3473, even if it moves to any extreme directions 1.3623 or 1.3323 then Theta is not turning into positives.

Here, Theta was in the range of -25.79 to -32.82 when the options value at execution SGD 1121.45 on Call & SGD 1863.75 on put respectively.

Remember, for a long option position, negative theta is good for holder.

Theta has not been that sensitive to option's value to the passage of time.

This is an unlimited profit on either side, limited risk to the extent of premium paid. The position is taken when the options trader thinks that the underlying stock will experience significant volatility in the near term.

Large gains for the long guts strategy is attained when the underlying currency price makes a very strong move either upwards or downwards at expiration.

Utilize ATM Puts on Long Guts of USD/SGD Theta

Thursday, June 4, 2015 6:39 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings