The upside risks to crude oil are expected to be limited through this year; although the rally momentum has picked up into 2H17, the higher prices of late have also triggered more US oil supplies, according to a recent report from OCBC Bank.

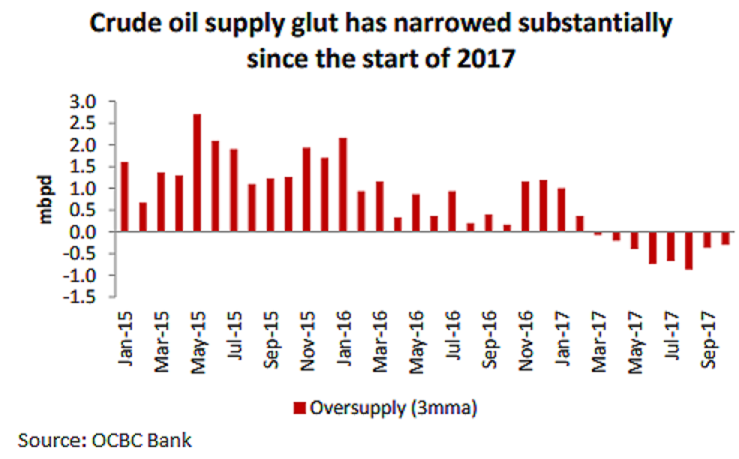

2017 has been an eventful year, especially for the energy complex. At the very least, crude oil prices have rallied from its low of the USD42/bbl handle in June to marginally exceed our year-end outlook of USD55/bbl. The uptick in oil prices is underpinned by the fruition of OPEC’s production cuts effort, recovering global growth and the consequent rebalancing fundamentals.

However, factors into 2018 could prove to be different, fraught with even more uncertainties that are bereaved of answers. Geopolitical tensions remain high on our list, while energy demand could moderate into the year given a strong H2 2017 base. Supply-wise, recent OPEC’s soft-deadline to extend oil curbs for nine months could mean an earlier-than-expected cessation of the deal.

Moreover, geopolitical tensions stay simmered in the backdrop and could disrupt global growth momentum should tensions intensify. With the recent OPEC-Russia agreement to extend their production curb plan by another nine months to end-2018, oil prices recently rallied another leg up. OPEC’s plan to limit supplies in an effort to buoy prices has come to fruition, especially with the rally in prices and narrowing supply glut.

"We do not see much headroom for oil to gain into 2018. With oil prices already at a strong approx. USD55 – 60/bbl now, we foresee prices to head marginally higher to at most USD70/bbl next year in the best-case event of a strong global demand and tame supply story," the report added.

Meanwhile, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence