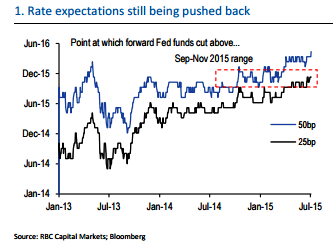

For the last 2-3 months, USD has been going sideways. It peaked in March, when markets were pricing in the first rate hike by September, but USD has retraced since then, in line with rate expectations that have also been pushed back.

For the last few months, there has been a steady drift in the US forward curve as we roll forward a month, the market consensus for the first Fed hike does the same. But US data continue to improve.

And even FOMC members themselves are tilted towards a September hike based on the dot plot, 60% of Fed members are pencilling in at least two hikes this year (Sept and Dec) and 90% are looking for at least one hike.

If the Fed skips September, Fed lift-off will shift all the way out to 2016 as they argue year-end liquidity concerns will make the odds of a December start to tightening very low. Along these lines, we think the odds of a scenario where the Fed starts in September and pauses are higher than starting in December.

As long as we are on track for a September hike, potential for USD is seen to make further gains into the end of this quarter, says RBC capital markets.

USD, will it be September or 2016?

Wednesday, July 8, 2015 5:58 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed