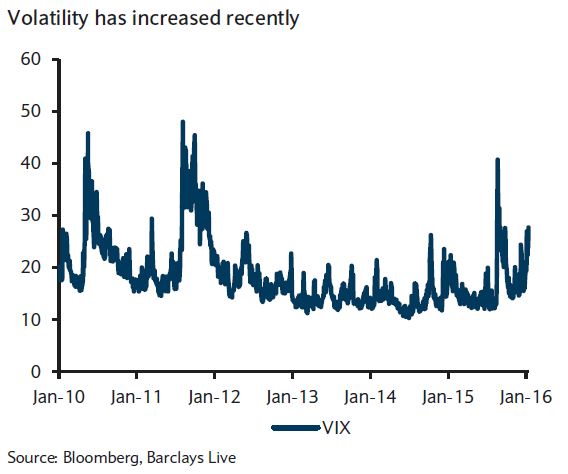

USD is expected to continue strengthening against EM currencies as market volatility continues to trend higher, according to Barclays. The financial turmoil in China have worsened the uncertainty surrounding China's growth and financial stability, coupled with a global slowdown in economic activity, commodity prices continue to decline, as supply has not decreased at the pace it was expected before.

"Despite doubts about the capacity of the Federal Reserve to increase rates in such an environment, we think that currencies such as EUR will underperform in the medium term because more stimulus is needed," added the bank notes.

The USD is not immune to Chinese growth concerns or CNY weakening, but if Fed policymakers are dissuaded from further policy firming, it is even more likely that other major central banks will push back tightening or ease policy further. In the near term, however, traditional safe havens such as the JPY could find support with increased risk aversion.

Brent and U.S. crude futures fell to the lowest since 2003 following the lifting of the sanctions at the weekend.

NYMEX crude for February delivery was down 86 cents at $28.56 a barrel, after falling more than $1 earlier to $28.36, the lowest since Oct. 30, 2003.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed