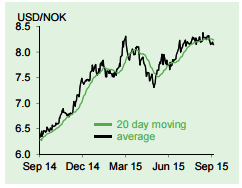

Norway's external position remains strongly positive, thanks in large part to its sovereign wealth fund, with a current account surplus of nearly 9% of GDP in Q2. This should help to limit the downside to the krone versus the US dollar, as would the anticipated improvement in crude oil prices over the medium term. Higher crude oil prices should help the krone appreciate back up to the 9.0/9.5 range against the EUR by year end, says Lloyds Bank.

The correlation between the crude oil price and the Norwegian krone continued to diminish over the past month. Focus has shifted to the impact the current low crude oil price may have on Norway's medium-term economic prospects and the implications for domestic interest rates.

Forward indicators suggest that activity will slow in H2, which would precipitate another 25 bps cut to 0.75% in coming months, states Lloyds Bank.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX