BoK might not have to raise the policy rates along with the US Fed's rate hikes to prevent potential capital outflows.

Historically, the Korean won was not an interest rate-sensitive currency, and policymakers usually worry about its "excessive" strength compared with the Japanese yen. However, the recent rise in the USD/KRW exchange rate raises concern on capital outflows.

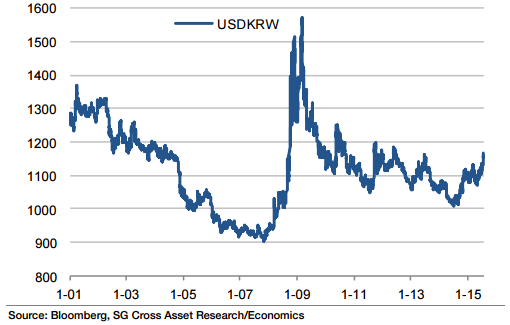

Though the Korean won may still be strong on the basis of nominal or real effective exchange rates, the pace of the rise in the USD/KRW (from 1,070 to 1,170 within 3 months) and the current level of the USD/KRW look worrisome.

The anticipation of the impending US Fed rate hike is considered a main driver behind the rise in the USD/KRW, so the USD/KRW might break the psychologically important level of 1,200 when the US Fed actually implements the rate hike, probably in September.

"But it should be difficult for the BoK to cut rates in H2 this year as further monetary easing could lead to a further rise in USD/KRW exchange rates,worsening concern regarding capital outflows and destabilising the overall financial market in Korea", says Societe Generale.

Korea still has a vivid memory of Asian currency crisis. Higher USD/KRW can be interpreted as a precursor of another financial turmoil.

USD/KRW exchange rates rise likely to raise concern on Korea's capital outflows

Tuesday, July 28, 2015 4:09 AM UTC

Editor's Picks

- Market Data

Most Popular

5

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed