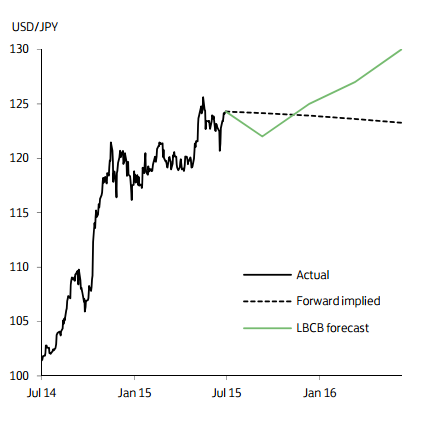

Having hit a 14-year high of 125.86 in early June, USD/JPY has since retraced slightly. Amid the rising tensions in Greece and a flight to safety, USD/JPY dropped to a low of 120.41 in early July. An improvement in Greece's fortunes over the past week, however, has seen the currency pair bounce back to mid-range at around 123-124. There has been little fundamental change in Japan's domestic outlook to justify a re-rating of the yen's medium-term prospects, and the trend decline in the Japanese currency remains in place.

Concerns over the economic outlook in China, weakening export growth, ongoing record monetary stimulus - the BoJ continues to expand its balance sheet by Y80tn pa - and the recent downward revision in the BoJ's growth and inflation forecasts underline the continued downside risks for the yen. While the yen could benefit from potential equity market volatility from a probable H2 rise in US interest rates (historically, USD/JPY has fallen when US equity markets have fallen), the prospect of additional policy stimulus amid ongoing weak growth is projected to push USD/JPY above 130 in 2016

USD/JPY Outlook

Monday, July 20, 2015 8:59 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX