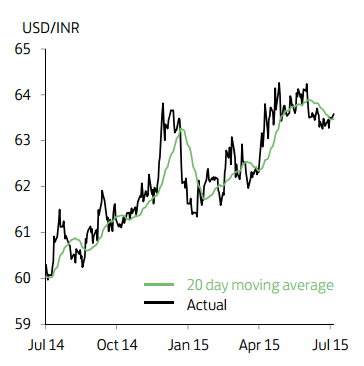

The Indian rupee has been on a gradual depreciating trend against the US dollar so far in 2015, with USD/INR rising to 64.47 in June - its highest level since its 'taper tantrum' selloff in September 2013. While the rupee has pared its losses in recent weeks, it remains vulnerable to renewed broad-based USD strength on rising speculation that the Fed could start raising policy interest rates later this year.

However, India's economic and policy fundamentals are markedly stronger than in 2013, suggesting the rupee should fare better this time around than most emerging market currencies. To emphasise this, the central bank has been able to cut interest rates three times this year and further cuts cannot be excluded at this stage. It has also been actively intervening in the currency market to keep the rupee competitive, dampen currency volatility and build its official foreign reserves. Meanwhile, the government continues in its efforts to boost foreign direct investment.

"We forecast the rupee to gradually appreciate against the USD over the forecast period," says Lloyds Bank.

USD/INR Outlook

Monday, July 20, 2015 9:59 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022