Global market attention is focused on the Chinese equity market after the sharp decline in prices since mid-June. The Chinese government has intervened with a range of targeted measures to prop up the market but their effectiveness remains uncertain. Although equity holdings are concentrated, there are growing concerns about the potential hit to broader consumer confidence. While recent data, including Q2 GDP (+7% y/y), proved stronger than expectations, it is too soon to rule out further policy stimulus.

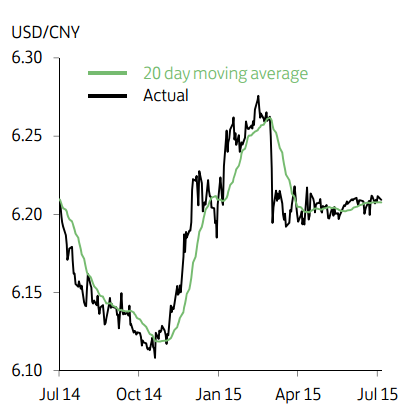

The central bank has already cut its main interest rate three times this year and a further reduction in the reserve ratio is also possible. In contrast, the exchange rate has been relatively stable, with USD/CNY hovering around 6.20 since late March.

"We believe the PBoC will continue to limit currency volatility to dampen uncertainty, while any significant yuan depreciation could exacerbate capital outflows. Looking further out, we remain of the view that the yuan will resume a gradual appreciation bias against the USD over the forecast horizon," says Lloyds Bank.

USD/CNY Outlook

Monday, July 20, 2015 9:49 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022