Since the Brexit vote, the USD/CAD pair has rallied by about 4 percent. This is likely due to the shifting US interest rate expectations, weaker Canadian economic fundamentals and lower crude oil prices rather than risk sentiment, said Lloyds Bank in a research report. According to consensus expectations, crude oil prices are likely to rise by the end of 2016. Thus a partial retracement in recent USD gains is expected, noted Lloyds Bank.

Moreover, global risk sentiment has steadied through July and August. Still, consecutive US non-farm payrolls releases above 250,000, underlines the US labor market’s strength. Simultaneously, monthly GDP data of Canada has also been a disappointment. This might result in the Bank of Canada to consider lowering rates. However, retail sales, inflation and manufacturing have been resilient so far.

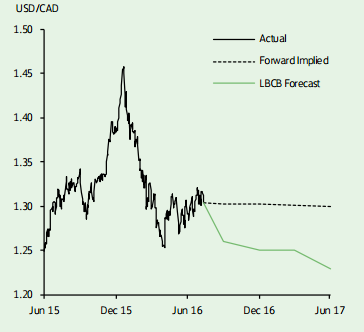

“We see some room for CAD appreciation, and forecast USD/CAD to decline towards 1.25 by end-2016 and 1.22 by end-2017,” added Lloyds Bank.

USD/CAD likely to decline towards 1.25 by 2016-end

Thursday, August 11, 2016 12:53 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX