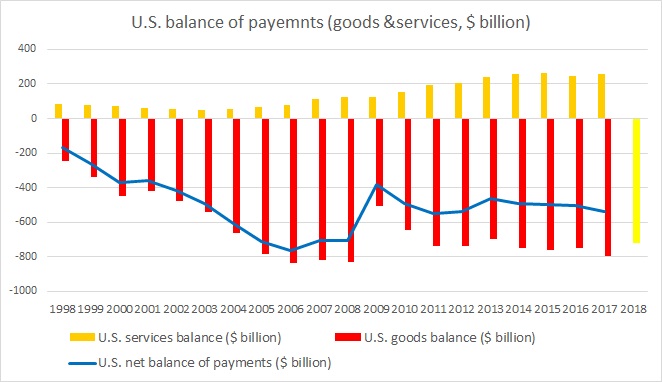

Despite all his harshest of rhetoric and actions towards ballooning U.S. trade deficit, President Trump seems to have failed to reign on it. Since his inauguration, President Trump and his team have taken actions to reign over the tariffs; imposing tariffs on steel and aluminum, taking harsher steps in terms of anti-dumping and countervailing duties, and imposing tariffs on goods from China but so far the impact isn’t getting reflected in actual data.

According to data from U.S. census bureau, the U.S. goods trade deficit with the rest of the world reached a new record high of $76.98 billion in October. At this rate, the U.S. trade deficit is set to surpass last year’s $795.69 billion in 2018.

The increasing trade deficit with more focused from investors thanks to President’s Trump’s war to reign on it is likely to act as a negative factor for the USD in the longer term.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances