Many reports in the media continue to suggest that a recession is looming in the United States. Today’s article in Reuters suggests

that large portions of economists are in agreement that recession risks are high. Well, after almost 9-years of continued expansion, almost everyone is worried since economy moves in cycles. One of the major reasons cited by the doomsayers are the continued rate hikes by the U.S. Federal Reserve.

We expect that as the Fed increases rates and reduce monetary stimulus, the volatility in the financial markets move up, which would lead to repositioning in the financial markets, which is likely to lead to selloffs in stocks, while money moves to higher yielding fixed income.

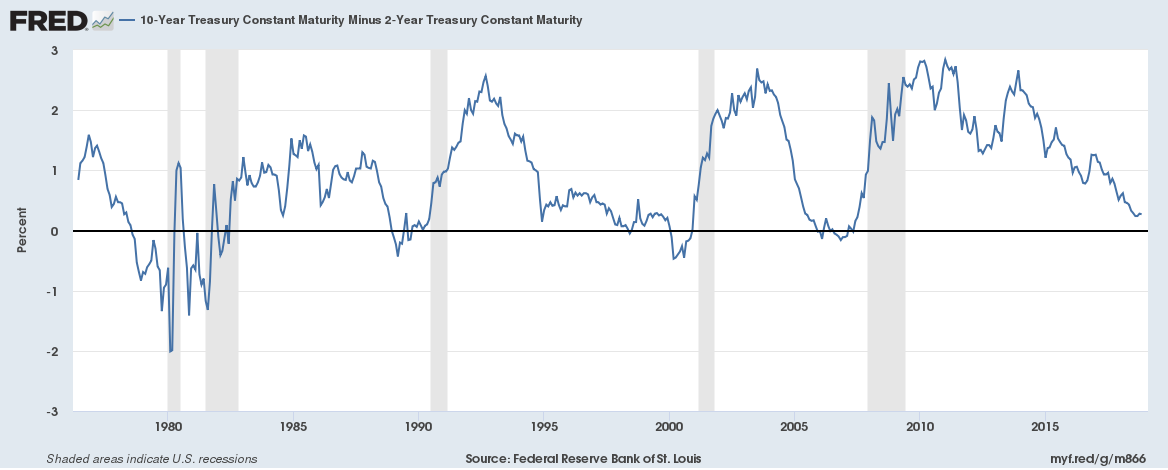

However, these changes do not guarantee a recession, and instead of fearing the looming recession, we would like to urge readers to follow on of the most reliable U.S. recession indicator; the yield spread between short & long-term bonds. Whenever the spread drops below zero, a recession follows in the next 12-24 months.

The last time the spread was below zero for the first time after a rise, was back in December 2005, and it was followed by the Great Recession of 2008/09. Before that, it was the year 2000, which was followed by dot-com bubble burst and recession.

The spread is currently at 27 basis points and unless it declines below zero, we do not see a looming recession. So, don’t bet too much on that as it could be delayed, just like it was in the 1990s.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals