President Trump’s harsh rhetoric to reign on China’s massive trade surplus with the United States has so far born little fruit than to make China cautious and reluctantly agreeing to discuss ways to resolve the trade imbalances between the two countries.

Since inauguration, the U.S. Commerce Department under Secretary Wilbur Ross has taken a more toughened stance against China with an almost 250 percent increase in countervailing anti-dumping duty investigations, and President Trump announcing tariffs on $250 billion worth of goods from China, as well as banning several U.S. companies from procuring equipment from Chinese companies like Huawei; but, that has done little to reduce goods imbalances with China.

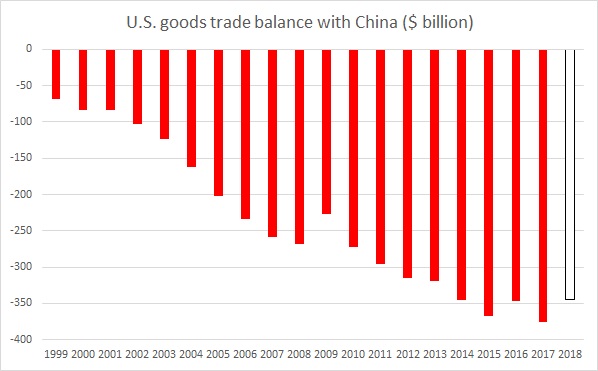

In fact, the U.S. goods deficit with China has now ballooned to a record high.

According to data from the U.S. census bureau, China’s goods trade surplus with the United States reached a record high of $43.1 billion in the month of October, with exports rising to record high of $52.2 billion and imports declining to just $9.1 billion, the lowest since July 2016. At this rate, China’s goods trade surplus with the United States would easily surpass last year’s record high of $375.6 billion.

The numbers are not likely to make President Trump happy, who after negotiations with Chinese President Xi Jinping to give negotiations another 90 days before imposing an additional 15 percent on Chinese goods worth $200 billion. The 90-day window expires at the end of March next year.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off