With US Federal Reserve looking to hike rates, investors and companies have postponed their investments unsure of what a first rate hike might bring.

So it is likely that US earnings might suffer in the second quarter which brings S&P500, Dow jones and NASDAQ at risk of decline after earnings release. Strong US dollar has made imports cheaper than domestic products.

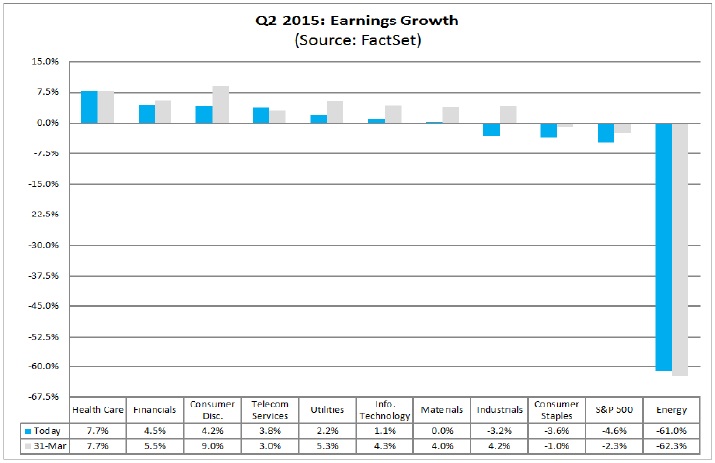

- The above chart shows, analysts' expectation of earnings in the second quarter.

- Analysts are expecting earnings to be down by -4.6% in the fourth quarter. This is the worst forecast since 2009. At end of March, Analysts were expecting decline of just -2.3%.

- Latest decline in earnings growth is being contributed by consumer discretionary (down to 4.2% from 9%), utilities (down to 2.2% from 5.3%), Information technology (down to 1.1% from 4.3%), materials (down to 0% from 4%), industrials (down to -3.2% from 4.2%) and consumer staples (down to -3.6% from -1%).

- Energy sector earnings are expected to decline the most by -61% and healthcare earnings are expected to be highest at 7.7%.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary