US Federal Reserve Chair Janet Yellen's testimony before congressional committee revealed her confidence on US economy.

According to Ms. Yellen -

- Downside risks to US economy from global economic and financial developments diminished since September.

- Spare capacity in the job market has fallen significantly from earlier this year, despite recent slowdown in rate of job gains.

- Ms. Yellen acknowledged that sharp rise in mortgage rates could have a negative effect on housing, but she also said that US economy has come a long way from the crisis evident by an economy, where employment and income are rising.

- Chair Yellen shrugged off the idea of further easing at the moment and not until deterioration is significant.

On the rate hike front -

- According to Ms. Yellen, in current context a rate hike by US Federal Reserve at December meeting is a live possibility. She also noted though, that there hasn't been any decision made yet and FED will focus on how upcoming economic information evolve.

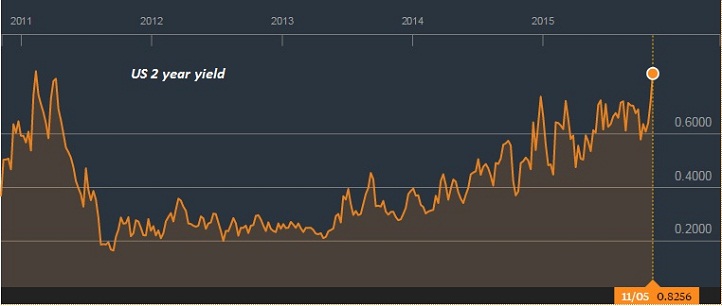

US 2 year yield has hit highest level since 2011, trading at 0.85% post Yellen testimony and market measure of probability for December rate hike moved up to 60%, pushing Dollar higher.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate