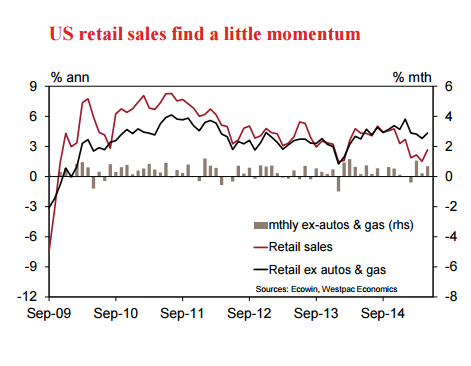

Retail sales found some momentum in May, rising 1.2% after a tumultuous weather and oil price affected four months to April (which saw a cumulative 0.5% gain). Core retail spending (ex autos & gas) posted a more modest 0.7% gain in May. In 2015, the FOMC has frequently noted its disappointment that the decline in petrol prices has not translated into stronger discretionary spending.

Instead, US households look to have held back, despite strong confidence and a favourable outlook toward incomes.

"We anticipate core retail spending growth will likely remain constrained in June, circa the 0.7% pace experienced in May," said Westpac Research in a report on Monday.

In contrast to May, auto & gas spending is likely to weigh on total activity in June, producing a modest 0.5% headline result.

US retail spending growth likely remain constrained in June

Sunday, July 12, 2015 11:29 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022