With concerns about the external environment contributing to the Fed's decision to leave policy unchanged in September, evidence of abating strength in the US labour market have cast further doubt on the prospect of a first tightening in 2015. September payrolls underwhelmed expectations, rising by just 142k, recording a second successive month of sub-200k growth. With the Fed requiring "some further improvement" in the labour market as a prerequisite to raising policy rates, the deceleration in employment growth has added some additional uncertainty over the pace at which this process is taking place.

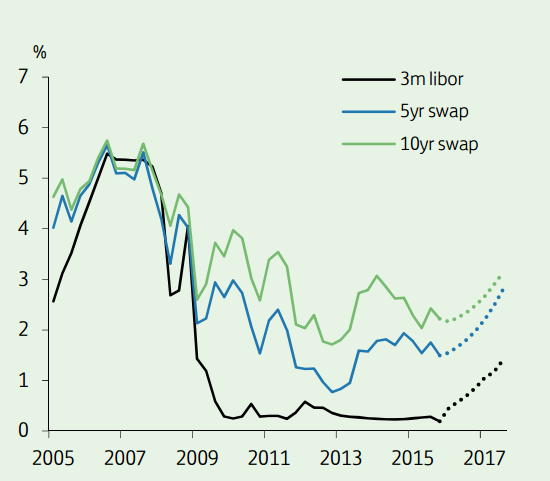

While several FOMC members have noted that even this slower pace of employment growth should still put downward pressure on the amount of slack, the divide between members has increased, bearing down on market expectations. Consequently, the market-implied probability of a rate hike by year-end has dropped to around 30% from around 50% before the September policy meeting, while 10-year Treasury yields have dropped by 15bps to 2.05%, having briefly dropped below 2%.

Looking ahead, an increase in the policy rate by year end remains most economists central view. The weakened external picture and dollar strength pose clear downside risks to the US economic growth and inflation outlook. However, there are still reasonably compelling grounds for the Fed to start raising interest rates this year.

"We doubt the slowdown in China will derail US growth prospects, especially given the underlying resilience of US domestic demand", notes Lloyds Bank.

Moreover, although the pace of job growth has slowed, the unemployment rate at 5.1% is well below the rate that previously would have already prompted a Fed tightening. There are two labour market reports before the key 16 December FOMC meeting. If these show renewed strength against a backdrop of more stable international conditions, the Fed is likely to raise interest rates at this meeting.

US rates review

Thursday, October 22, 2015 1:34 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX