The CNY devaluation and potential for greater market alignment argue for lower US yields, as the hiking cycle should be gradual and term premia should be lower. The reduction in China's Treasury holdings in this environment is unlikely to put upward pressure on yields.

"We are turning tactically neutral on our conditional 5s30s bearflattener, as forward breakevens have room to widen if the Fed delays the cycle," says Barclays.

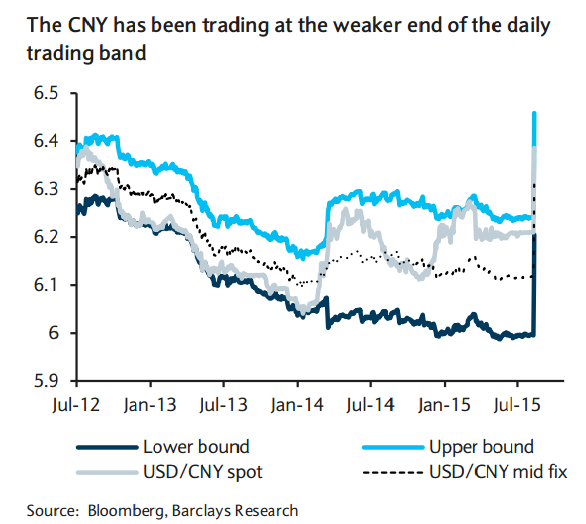

The highlight of the week was the PBoC announcing a move to improve the pricing mechanism of the daily fixing rate, noting that the quotes of market makers should refer to the previous day's closing rate and take into account FX market supply-demand and major global currency movements1 . In the Q&A, while discussing the timing of these changes, the PBoC noted that the real effective exchange rate was relatively strong and was not entirely consistent with market expectations. Since the beginning of the year, the CNY has consistently been trading at the weaker end of the trading band.

The announcement has already led to a 3% depreciation of the CNY against the USD, with the CNY weakening to as much as 6.45. The move had spillover effects across major global markets with core sovereign bond yields declining 10-15bp, S&P selling off 2%, and crude oil falling roughly 4% in response. Investors are largely viewing this move in the context of previous easing measures and as a signal that China's economy is probably weaker than previously thought. Falling commodity prices and the weakening CNY are bringing disinflationary concerns back to the fore. 5y5y inflation swap rates have been steadily declining across major markets and are not far from the lows.

US rates: Weekly review

Friday, August 14, 2015 12:27 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed