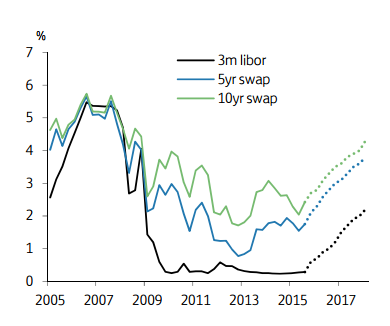

US bond yields have had a volatile month in response to developments in China, Greece and domestic monetary policy. Having hit an intra-month high just shy of 2.5% in late June, the yield on the 10-yr fell to a low of 2.19% in early July - pulled lower by the sharp fall in Chinese equity prices, growing tensions in Greece and weak earnings growth in the June employment report. Since then, however, risk sentiment has improved. Chinese equity prices have stabilised, a deal appears to have been struck in Greece and, amid general signs of economic strength, the Fed has highlighted the possibility that interest rates may rise by the end of the year. Treasury yields have rebounded, with the 10-yr back towards 2.4% - little changed from its level in mid-June.

In recent testimony to Congress, Fed Chair Yellen noted that a rise in policy rates this year would be "appropriate" if the labour market continues to improve and there is reasonable confidence that inflation will move back to target over the medium term. There remain clear signs that the labour market is improving, with the latest report showing the unemployment rate dropping to a cyclical low of 5.3%. If the US economy posts a strong rebound in Q2 and early Q3, there is a strong chance the Fed will raise policy rates in September. Key in this regard will be the next two Employment Reports, Q2 GDP and the Employment Cost Index.

Fed Chair Yellen has emphasized that an earlier tightening could reduce the need for a more aggressive response thereafter - adding weight to the view that the Fed is more likely to move in September than December. Overall, the Fed is expected to raise rates by 25bp at the end of Q3, and for this to be followed by 75bp of tightening through 2016. The bond markets already appear priced for a rise in rates later this year, but the crystallisation of this risk is likely to push yields higher.

"We forecast 10-year yields at 2.5% by the end of 2015 and 3.0% by the end of 2016," says Lloyds Bank.

US rates: Monthly review

Monday, July 20, 2015 10:27 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX