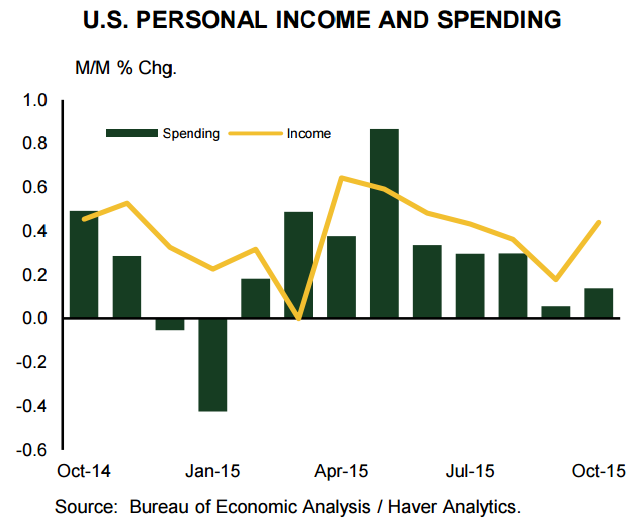

The buoyancy in labor market activity and strong gains in rental and other proprietary income should continue to bolster personal income. Personal income is expected to advance a further 0.2% m/m in November, following the robust 0.4% m/m advance the month before. Spending should also be up on the month, gaining 0.3% m/m, reflecting the strong start to the busy holiday shopping season.

The savings rate should drift modestly lower, as US households dip into their formidable savings war chest. Real spending activity is expect to rise, gaining a further 0.2% m/m, as consumer spending continues to provide a crucial tailwind for the economic recovery.

On the inflation front, the core PCE deflator is expected to rise at a relatively subdued 0.1% m/m pace, with the annual pace of core PCE inflation remaining unchanged at 1.3% y/y, reflecting the lingering weakness in domestic inflationary dynamics. This benign inflationary backdrop should persist in the coming months, with the annual pace of core PCE inflation remaining well below the Fed's 2.0% y/y target until sometime after 2017.

US personal income to advance a further in November

Monday, December 21, 2015 12:42 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX