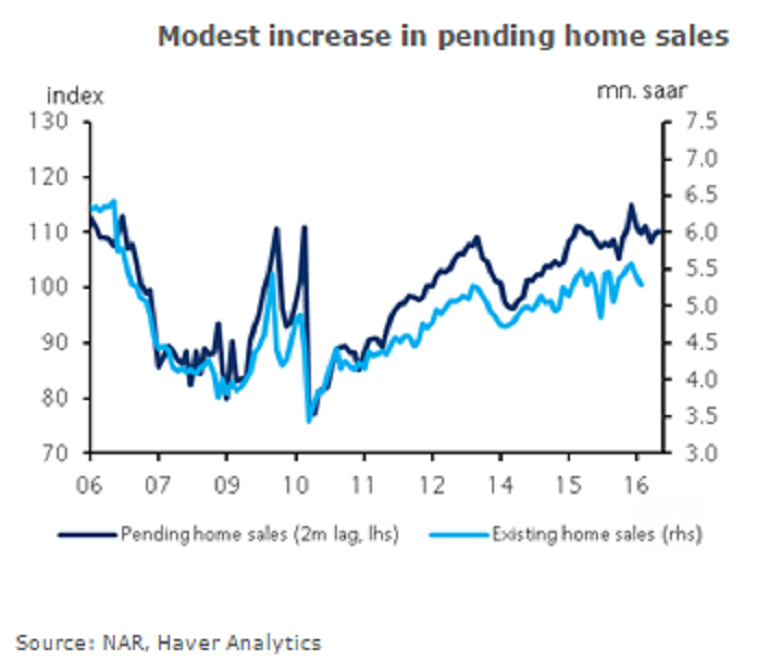

Pending home sales in the United States marginally rose during the month of October, showing off a steady improvement in the housing sector through this year and next. Also, a limited quantity of existing home inventories led to the mild rise in sales, despite a strong consumer-led residential properties demand.

US pending home sales rose 0.1 percent m/m in October, coming in line with consensus estimates. The September print was revised lower by one-tenth to 1.4 percent m/m. Sales increased in the Northeast, Midwest, and West on the month, data released by the National Association of Realtors (NAR) showed Wednesday.

However, sales declined 1.3 percent in the South, following solid growth the previous month. On the whole, today’s data are consistent with market view of steady improvement in the housing sector through this year and the next.

Further, there are underlying concerns surrounding the availability of houses in the market, raising eyebrows over a possible upward pressure on the prices. This year, 40 percent of sales were above list price compared with 33 percent last year, reports said.

Although worries remain regarding the overall health of the economy, guidelines remain to be framed post the Federal Reserve December monetary policy meeting and the new policy framework to be revealed by the President-elect Donald Trump.

Meanwhile, the dollar index has formed a bullish pattern at 101.43, down 0.09 percent at the time of closing, while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -18.48 (a reading above +75 indicates bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality