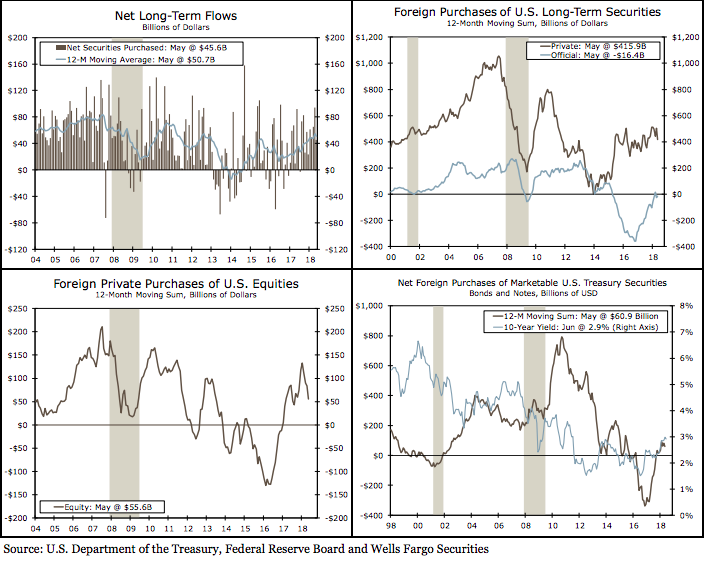

The United States’ net foreign purchases of long-term securities slowed in May, although foreign private institutions are still willing buyers of U.S. Treasury and corporate debt. Foreign official institutions remained net sellers in the month.

Net buying increased a smaller USD45.6 billion, down from April’s USD94.0 billion jump. Foreign private buyers accounted for all of the long-term gain, as foreign official institutions continued to be net sellers in May. Foreign private buyers continue to unload equities, selling a net USD27.8 billion in May, the largest outflow since 2007.

Foreign private buyers continue to have a strong appetite for long-term U.S. Treasury securities, with net foreign private purchases rising USD50.5 billion in May, on the heels of a similarly solid USD43.5 billion increase in April.

"Capital inflows remain relatively healthy; but, as trade rhetoric has heated up more recently, we will be watching for how this impacted demand for U.S. securities in June," Wells Fargo Securities commented in its latest research report.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns