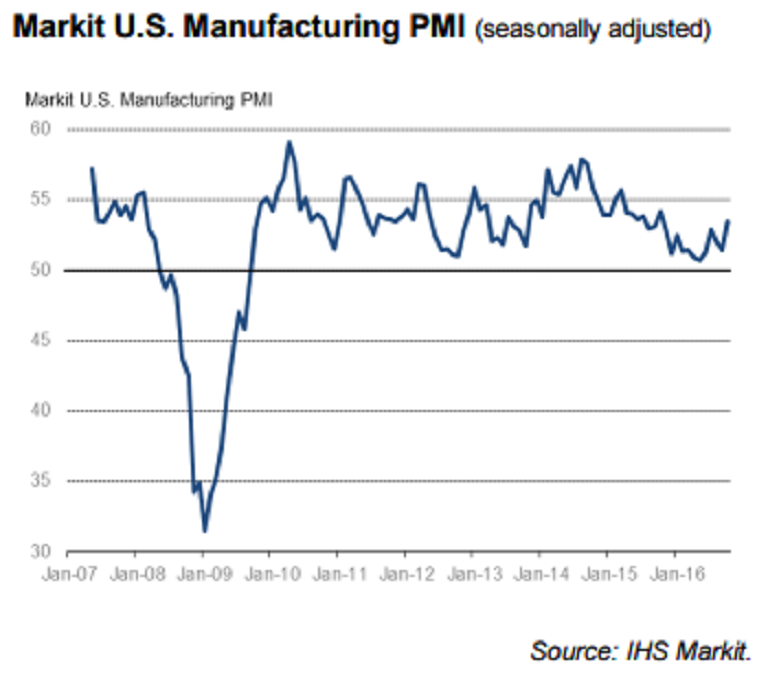

Manufacturing activity in the United States rebounded from a 3-month low during the period of October and manufacturers see a likely improvement in the country’s business conditions in the near future, turned higher by strong output and growth in new business.

U.S.’s October headline Markit Final U.S. Manufacturing Purchasing Managers’ Index (PMI) was slightly better than the earlier flash reading of 53.2, coming in at 53.4. That was a marked improvement over September’s 51.5 and the best reading recorded for a year.

Driving the PMI higher in the latest survey period was a strengthening in production, which was in turn supported by a marked upturn in new orders. In both cases, rates of growth indicated by respective sub-indices were at their strongest in a year, reportedly the result of firmer market demand and the development of new products.

Further, October’s survey implied that domestic demand was the key in driving the expansion of new order books. Rising production and new order requirements placed some pressure on capacity during October, with backlogs of work increasing to the greatest degree in three months.

"While output growth is accelerating, so too are inflationary pressures, which will further fuel speculation that the Fed will hike interest rates again in December," said Chris Williamson, Chief Business Economist, IHS Markit.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations