The US manufacturing ISM for October declined to 50.1 from 50.2 and the details of the survey were better than the headline.

New orders increased to 52.9 from 50.1, which is the best level since July this year. Customer inventories, which is our preferred inventory measure in the survey, declined to 51.0 from 54.5 and the order-inventory differential took a rebound from the dip last month but remains depressed.

"The inventory index also showed a decline to 46.5 from 48.5 and overall suggests that the inventory correction evident in the Q3 GDP report continued into Q4 for the manufacturing sector", says Danske Bank.

New export orders increased to 47.5 from 46.5, suggesting some stabilisation in global demand. The employment index softened to 47.6 from 50.5 and 11,000 drop is pencilled in manufacturing employment for Friday's non-farm payrolls report but stick to our estimate of 170,000 in overall job growth.

The import index showed a major dive to 47.0 from 50.5, the weakest level since June 2009. This stands in contrast to other data suggesting that domestic demand remains solid and it might be related to the drop in inventory accumulation.

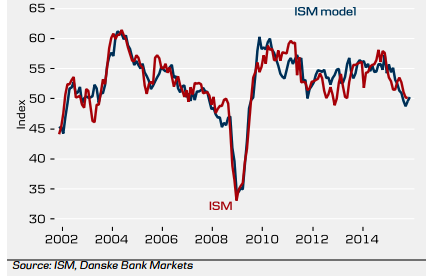

"The short-term ISM model and the 'new orders- customer inventories' differential both suggest an ISM around the 50 level in the coming month, but it is likely pastthe bottom. A turn in the global manufacturing cycle in the coming months would bolster the Fed's outlook for US growth above trend next year and we continue tobelieve that the first rate hike will come in January", added Danske Bank.

US manufacturing ISM likely bottoming

Tuesday, November 3, 2015 5:39 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed