The United States rate of unemployment ticked modestly higher during the month of September, although the participation rate among the working age population soared to six-month high during the period, indicating that the country’s labor market has started to show signs of stabilization that could well support the case for an interest rate hike in December.

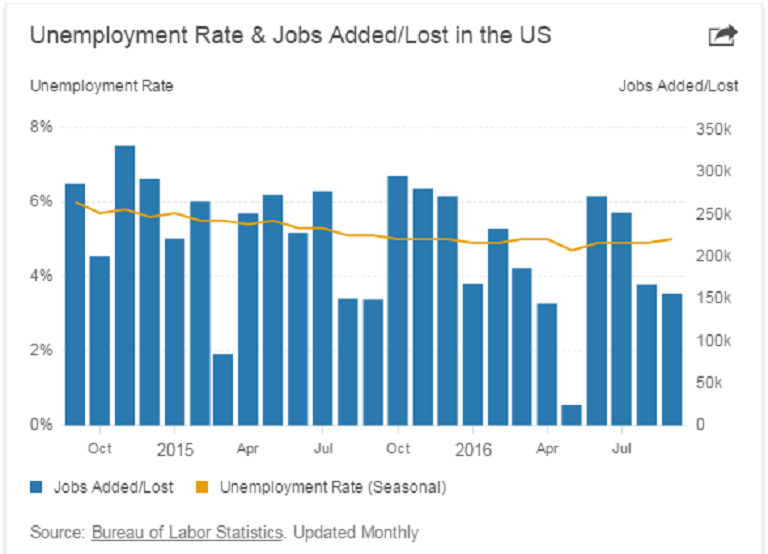

The U.S. jobless rate rose slightly to 5.0 percent in September, from 4.9 percent in August, defying expectations for no change, data released by the US Labor Department showed Friday. Also, the U.S. economy had a net gain of 156,000 jobs in September, the report showed.

Further, the report showed that 7.9 million Americans are out of work, a number that changed little in September. Another 5.9 million people are considered 'under-employed,' because are working part-time, but want full time work.

A positive report on the job market tends to help the incumbent political party, which is trying to convince voters that it has done a good job managing the economy. Bad economic news could help persuade voters that it is time for a change of leadership.

A mixed bag of labor market data increased complications for the United States Federal Reserve, which has kept rates on hold for a sufficient amount of time, waiting to witness an improvement in the economy. However, the rise in participation rate has more than offset the marginal rise in unemployment, strengthening the case for a rate hike in December.

Meanwhile, employers continued to add to payrolls in September as record openings drew more Americans into the workforce and most found jobs, indicating the U.S. labor market is settling into a pace that will support the economy.

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed