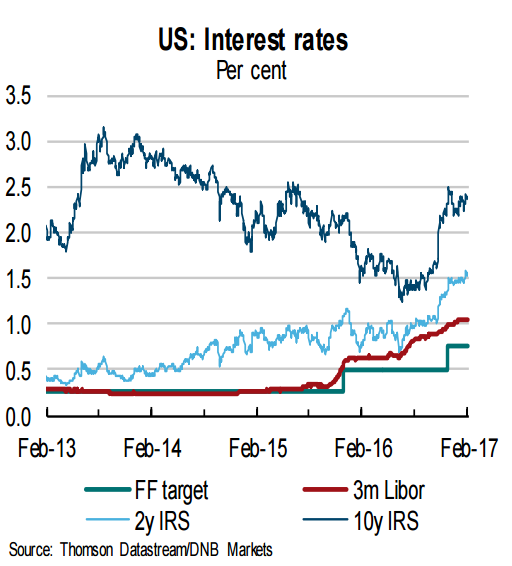

Minutes of the Federal Reserve's Jan. 31-Feb monetary policy meeting published earlier this week on Wednesday showed that many policymakers believed another interest rate hike might be appropriate "fairly soon" if labor market and inflation data meet or beat expectations. Most members expect a continuation of moderate expansion in economic activity and a gradual rise in inflation to target over the medium-term.

Data released on Thursday showed that U.S. initial jobless claims for the week ending February 18 rose slightly last week by 6,000 to a seasonally adjusted 244,000. It was the 103rd straight week that claims remained below 300,000, a threshold associated with a healthy labor market. The four-week moving average in initial claims, considered a better gauge, fell modestly, to 241,000 from 245,000, in a sign of a strengthening labor market.

"Altogether, we see little in the recent jobless claims data to change our view on labor markets. Despite some volatility in the data around year-end, the claims data continue to point to a low rate of separation activity in labor markets and are suggestive of favorable labor market conditions overall." said Barclays capital in a report.

The next payrolls report will clearly be key, but we also have a stream of speeches from Fed speakers between now and the 16 March decision which will be important for shaping expectations. Furthermore, the core PCE inflation release for January, due 1. March will also be important. Fading optimism surrounding US President Donald Trump's proposed fiscal policies dimmed prospects of a Fed rate hike move at its upcoming meeting in March.

"We maintain our call for two hikes in 2017 - most likely in June and December," said Knut A. Magnussen, Senior Economist DNB Markets.

Markets were looking for a firmer signal from FOMC minutes and were left disappointed after the release. The USD sold off and bonds rallied post the release on Wednesday. Thursday's comments from Treasury Secretary Steven Mnuchin, providing little details for the proposed tax reforms, did little to ease market concerns. Broad-based US Dollar selling extends on third consecutive session. USD/JPY was trading at 112.33, while EUR/USD was at 1.0607 at 1200 GMT.

FxWirePro's USD hourly strength index was bearish at -70.1237. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility