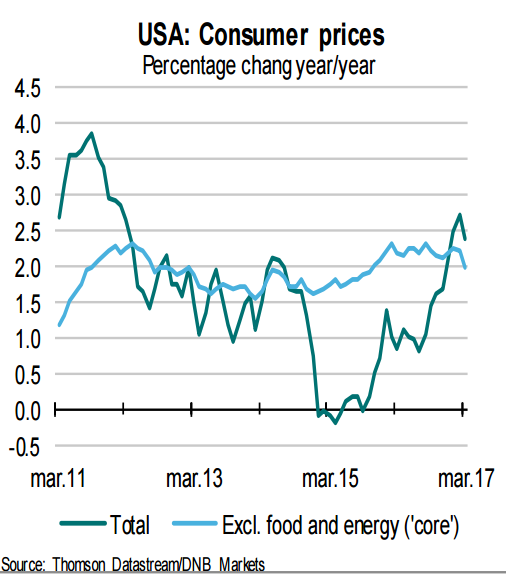

A report by the Labor Department on Friday last week showed U.S. Consumer Price Index dropped 0.3 percent in March, the first decline since February 2016. March US CPI inflation was much weaker than expectations for an unchanged reading. Declining costs for gasoline and mobile phone services offset rising rents and food prices. However, analysts feel several of the declines in March appear outsized and are likely to be reversed.

The core CPI, which strips out food and energy costs, declined 0.1 percent, the first and largest decrease since January 2010, after rising 0.2 percent in February. A 6.2 percent drop in gasoline prices was the biggest factor in the monthly decline in the CPI. Monthly consumer inflation was also weighed down by a record 7.0 percent drop in the cost of wireless telephone services.

Market expectations of a rise in interest rates at the Fed’s June meeting have fallen to about 50 percent, from more than 60 percent a week ago. Analysts feel the inflation miss was mainly due to temporary factors, and with the annual trend in the Consumer Price Index being still upward, should not worry the Fed too much. The monthly decline could likely reinforce the Federal Reserve’s plan for a gradual rise in interest rates.

"Some Fed officials will be disturbed by the unexpected drop back in core inflation, but this won't prevent a June rate hike," said Paul Ashworth, chief U.S. economist at Capital Economics in Toronto.

Consumer confidence remains elevated, indicating a pick-up in consumption growth. In particular, the current conditions rose to a 16-year high and is traditionally well correlated with labour market developments. Initial claims dropped by 1k to 234k last week. The trend has stabilized in the past few weeks and is consistent with high employment growth. GDP numbers which are scheduled to be released on April 28 will be in focus for impact on investor sentiment.

Dampened expectations of a faster Fed rate-tightening cycle coupled with the ongoing downslide in the US treasury yields further undermined the US Dollar demand. DXY was down 0.28 percent trading at 100.02 at 1130 GMT. At the same time, FxWirePro's Hourly USD Spot Index was at -69.4983 (Slightly bearish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says