US November headline CPI inflation moved upwards, led by base effects from the sharp decline in energy prices of last year. The rate has inched higher to 0.5% yoy from that of its previous month's 0.2%.

"Headline CPI inflation is likely to rise more quickly in coming months. We currently project a pickup to around 1½% y/y in January, although that forecast depends on a stabilization in energy prices", says Nordea Bank in a research note.

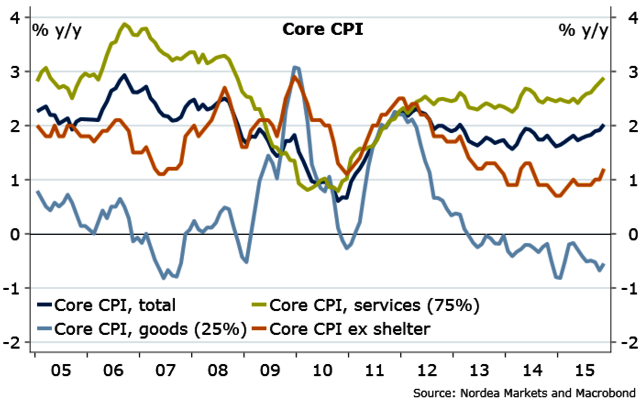

Inflation in core goods price stays negative. Nonetheless, the fact that core goods prices are not declining in a faster pace compared to last year, indicates that the changes in USD to US consumer prices persist to be limited.

The CPI report does not change the argument for gradualism after tomorrow's likely lift-off in Fed rates.

"Nonetheless, we stick to the view that rising inflation pressures will imply that the pace of Fed tightening during 2016 will be faster than is currently priced in by markets. At present, the market is priced for about two hikes in 2016, compared with four hikes in the FOMC's dot plot and our own forecast", added Nordea Bank.

US inflation pressures continue to mount

Wednesday, December 16, 2015 6:08 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX