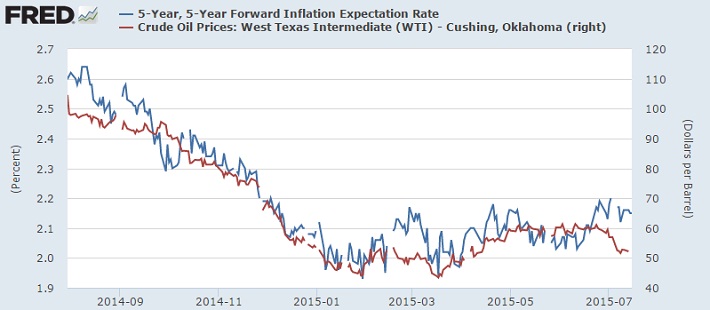

The above chart shows that inflation expectations in US may not be rising rapidly, however it has disconnected somewhat from energy prices.

- In 2014, inflation expectations as measured by 5 year-5 year forward inflation expectation rate, dropped sharply from 2.64% in August to 1.98% by January 2015 as WTI crude prices dropped from $100/ barrel to below $50 per barrel.

Some interesting changes are occurring this month.

- On Thursday, June 11th WTI was trading at $60/barrel and inflation expectation was at 2.03%. Since then WTI has dropped to $50/barrel but inflation expectations rose to 2.20% on July 2nd.

It is too early to say that inflation expectations are focusing beyond lower energy prices but it is giving an early indication that the effects of lower energy prices might be dissipating. However, if crude drops from here sharply beyond $40/barrel, it might pose some headwinds for inflation, both actual and expected.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?