In spite of hanging to its all-time high US equities are having bad year so far.

S&P 500 is trading mostly sideways this year so far. Currently trading at 2091, up less than 1% so far this year.

Investors are clearly worried over rate hike prospects from US Federal Reserve for first time in 9 years. Eurostxx50 and Nikkei 225 have clearly outperformer S&P500 this year so far as in both country central banks (ECB and BOJ) kept the tap open with massive easing. EuroStxx50 is up 11.5%, while Nikkei is up 17.2%.

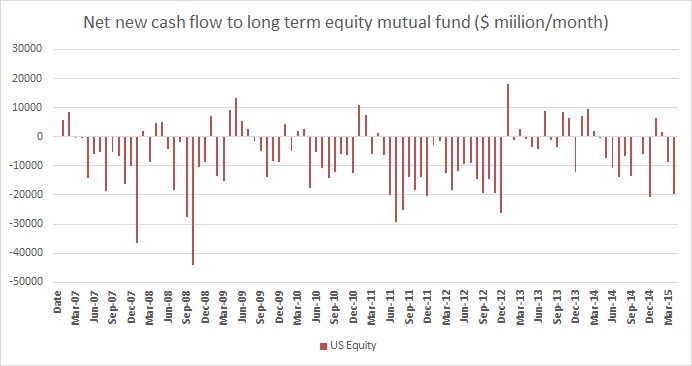

Money flow in US -

- The above chart shows flows of Money to US long term mutual funds. This year US funds are seeing massive outflow of money last seen during 2011-12 when market was in turmoil.

- After $ 8 billion withdrawal in March, investors have withdrawn $19 billion in April and more than $15 billion in May.

US equity index is unlikely to consolidate as investors are likely to remain cautious over first rate hike from FED reserve.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate