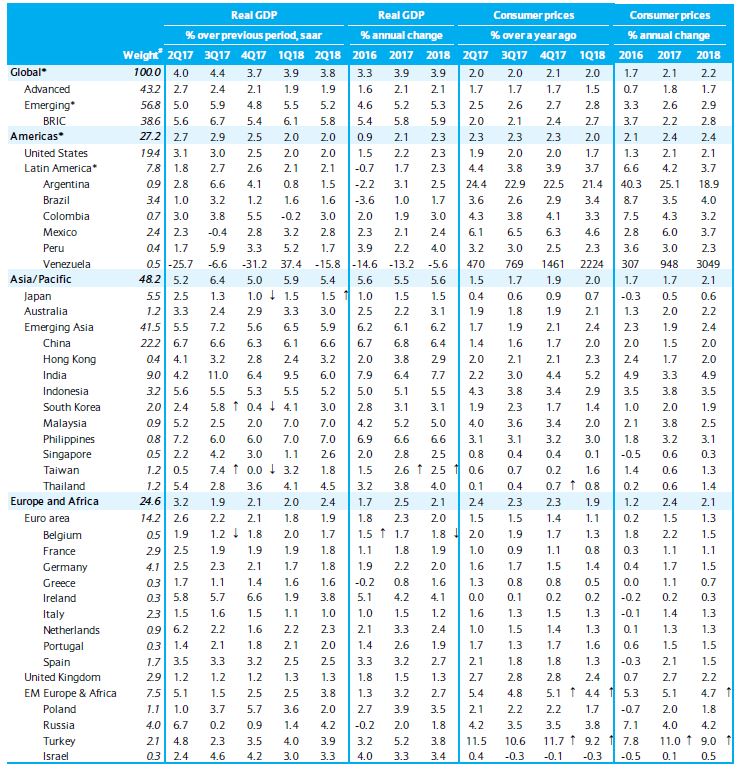

The United States is expected to expand 2.3 percent in 2019 after September data received this week were stronger than expected and suggest that the Q3 GDP growth could be revised higher, according to a recent report from Barclays Research. Further, data received for October point to solid growth momentum extending until year-end.

The November FOMC statement upgraded the FOMC’s assessment of the current activity environment to “solid” from “moderate” in September. This is the most upbeat the statement has been in its assessment of the trajectory of the recovery in at least a couple of years.

That the economy managed to grow at 3.0 percent q/q saar, in spite of the drag on industrial production, retail sales and equipment investment from the hurricane landfalls in August and September, will likely be interpreted by the FOMC as a sign that underlying momentum is pretty strong. Coupled with the rebound in employment in October and the fall in the unemployment rate, we think the evolution of the data brings the FOMC one step closer to cementing their view that an increase in the federal funds rate in December is likely to be appropriate, the report added.

Strong September data suggest Q3 GDP growth could be revised higher The September construction spending report was stronger than we expected, primarily driven by a solid increase in public sector spending. The September trade deficit widened in line with expectations and left the Q3 GDP tracking unchanged at 3.1 percent.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/inves

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk