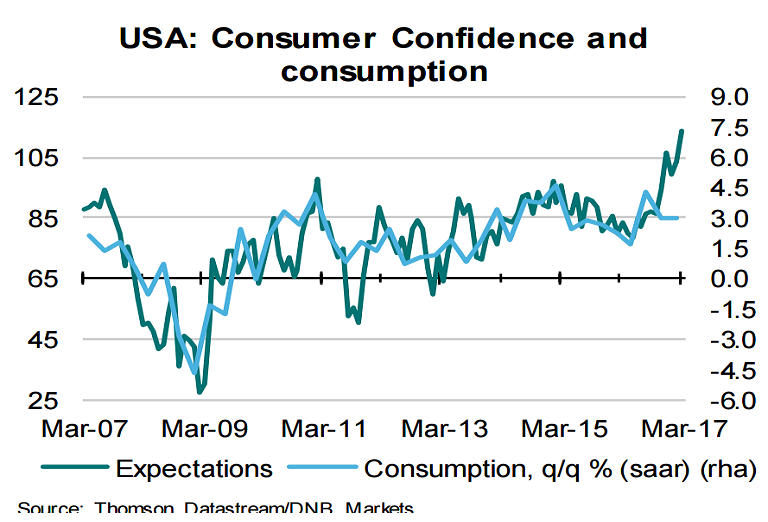

U.S. consumer confidence defied economists' expectations for a fall and unexpectedly improved in the month of March. Data showed that U.S. Conference Board consumer confidence index jumped to 125.6 in March from a revised 116.1 in February, surprising markets who had expected the index to dip to 113.8 from the 114.8 originally reported for the previous month.

The Conference Board said the present situation index rose to 143.1 in March from 134.4 in February, while the expectations index increased to 113.8 from 103.9. Consumers' assessment of current business and labor market conditions improved considerably. Optimism towards the short-term outlook for business, jobs and personal income prospects also improved.

"Consumers feel current economic conditions have improved over the recent period, and their renewed optimism suggests the possibility of some upside to the prospects for economic growth in the coming months," said Lynn Franco, Director of Economic Indicators at The Conference Board.

The mood of consumers is closely monitored because their spending accounts for about 70 percent of U.S. economic activity. Optimism for faster economic growth since the election of President Donald Trump, along with rising stocks and steady labor-market gains, has supported consumer sentiment. Both consumer and business confidence have surged in the aftermath. That said, confidence may be at risk of fading in the coming months should other parts of Trump’s agenda stall following last week’s failure of health-care legislation backed by the president and Republican leaders.

"Recovery is what the survey indicates and, more to the point, the answers on jobs and income are rooted in current experience not expectations for what Trump will or won't do," said Steven Blitz, chief U.S. economist at TS Lombard.

"If reality pans out as consumers and we expect, the Fed has three more hikes to go before the year is done." he added.

U.S. dollar index was trading 0.42 percent higher no the day at 100.10 points at 1200 GMT. At the same time, EUR/USD was trading at 1.0740 while USD/JPY was at 110.85. FxWirePro's Hourly USD Spot Index was at bullish at 89.6811 at around 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality