While US existing home sales, new home sales, building permits, housing starts all have bounced back, exciting investors and pushing first rate hike closer, several housing sector indicator points at prevalent weakness in the economy and suggests that the sector might suffer over FED tightening.

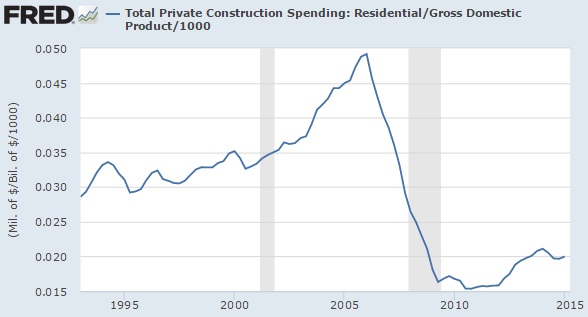

- The chart shows, construction spending as a percentage of GDP remains far below from pre-crisis level, even low compared to historical standard.

- The housing market, though showing signs of recovery has not even reached pre-crisis level. Housing starts have recovered sharply in April but still remains at lowest level not seen for at least six decade when compared to US population growth.

This means investments in the sector still remains weak compared to historical standard and now hike by Federal Reserve threaten to derail it further id wage recovery doesn't pick up sharply.

- Home ownership level in US has fallen to levels last seen in the 80s, which says American home dream might be over for good.

With rental costs rising faster than wage growth and more American preferring to rent, this will be a drag on consumers' wallet reducing potential spending ability.

- It seems not a surprise that Private income rose in April but consumption did not.

As of now, market participants remain divided over the timing of rate hike and awaits clarification from FED, when it announces policy decision on May 17th.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand