With nearly $2trn in assets and continued steady inflows, asset allocation mutual funds are becoming increasingly important in the US, as drivers of bond and equity performance. The negative bond-equity correlation that has persisted since the late 1990s reduces portfolio volatility and encourages leverage or lower cash holdings.

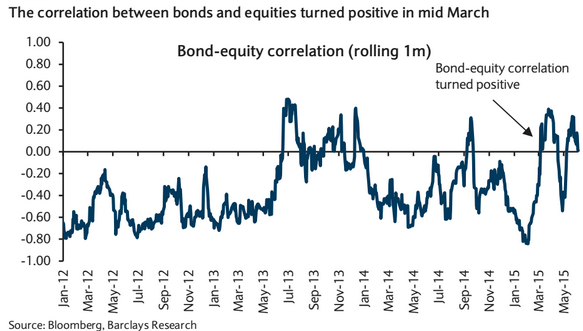

However, similar to the taper tantrum of 2013, the bond-equity correlation turned slightly positive in mid-March; the softness in equities failed to offset the selloff in bonds, raising portfolio volatility, notes Barclays.

Asset allocation funds are underweight bonds, neutral equities and overweight cash. Balanced funds cut bond exposure considerably as measured by their beta. On the other hand, equity positioning was underweight in April and moved back to neutral as equities outperformed.

Overall, the drawdown at balanced funds through the bond selloff has been 1.8%, much less than the falls in bonds and equities. This suggests cash holdings are fairly large given the rise in the bond-equity correlation. Indeed, ICI data show that liquidity ratios at cross-asset funds are at 11%, near the highs of 1994-95, notes Barclays.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed