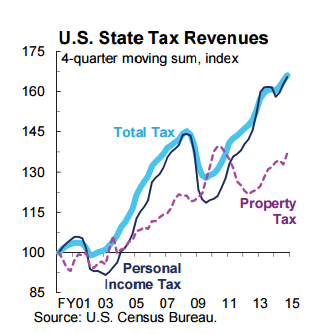

U.S. State Budgets for fiscal 2016 (FY16)1 , in aggregate indicate only moderate spending growth, gradually replenishing priorities such as K-12 Education. This is despite the pick-up in State tax revenue growth to 5.1% y/y for the first three quarters of FY15.

Moreover, the States' FY15 year-end results should be supported by buoyant Q4 personal and corporate income tax collections, reflecting final 2014 tax year payments. For FY16, however, the State Budgets project a 3.0% General Fund revenue gain, less than the estimated 3.7% rise in FY15, but stronger than the 1.6% increase reported for FY14. Lingering State caution mirrors the U.S. economy's slow start to calendar 2015 and elevated uncertainty in many policy areas. While the federal Supreme Court ruling upholding the sale of health insurance subsidies through exchanges addresses one near-term uncertainty, short-term fixes remain the default option for other issues such as the federal Highway Trust Fund. Substantive longer-term challenges for the States include their widening infrastructure gaps, rising health expenses and their retirement benefit obligations.

Emerging regional differences are striking in FY15 and FY16. Oil-producing States are restricted by the outlook for an extended period of lower WTI oil prices. So too are the major coal-producing jurisdictions as power generation shifts in response to climate change considerations and affordable natural gas prices. Across the States, a modest net tax increase of $3.0 billion is planned for FY16, led by hikes in Alabama, Connecticut and Pennsylvania, with a further $1.7 billion boost from other revenue measures.

US State Budgets For Fiscal 2016 Remain Cautious

Sunday, July 19, 2015 11:25 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed