Barclays notes:

We believe the Fed is unlikely to make material changes to the outlook and do not expect it to signal a September hike at the upcoming meeting. Against the backdrop of a strengthening USD and falling commodity prices, there is little reason for the Fed to surprise hawkishly, in our view. However, the meeting would be perceived as hawkish if it highlighted the recent improvement in core inflation and the widening in forward breakevens from the lows. We maintain our ffz5-z6 curve steepener, long 6m3y risk reversals and recommend 3m5y versus 3m30y bear-flatteners to position for this risk.

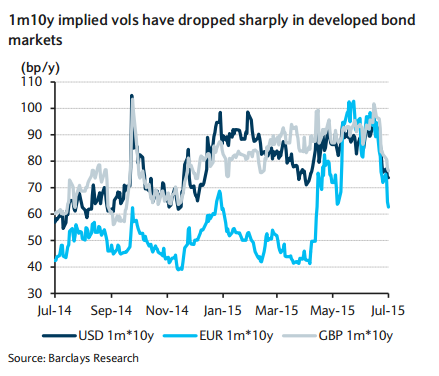

Global bond yields drifted lower this week amid a continued selloff in commodities; WTI crude sold off by 2%, copper by 3%, and agricultural commodities (corn and wheat) by 6- 7%. With yields grinding lower and a key risk event (the imminent breakdown of Greece negotiations) behind us, implied volatility in the developed bond markets has dropped quite precipitously over the past two weeks . At the same time, the long end continued its outperformance, with 5s30s flattening by another 7bp; the curve has flattened almost 20bp from the recent highs, likely helped by hawkish commentary from the Fed and the strengthening of the USD from the lows.

The Fed is scheduled to meet on July 29. We believe the Fed is unlikely to make material changes to the outlook and do not expect it to signal a September hike in the spirit of policy decisions being determined on a meeting-by-meeting basis. The Fed should reiterate that activity has been expanding moderately; the unemployment rate has fallen, the slack in the labor market has been gradually diminishing; and inflation continues to run below the longer run objectives. We believe that if the Fed wanted to convey information about timing of the first hike, it would be via changes to the description of the economic and the outlook, rather than via changes to the forward guidance.

We maintain our recommendation of prefer ffz5-z6 curve steepeners (initiated at 70bp) and being long 6m3y risk reversals in conditional space. Even if the Fed were to not hike at the September meeting, we believe the curve should not flatten much. In options, the modest skew suggests that the market is pricing in little tail risk of higher rates.

We also recommend initiating 3m*5y versus 3m*30y bear-flatteners through ATM payers. While the curve has flattened aggressively over the past few weeks, we believe that, in a rate selloff, it is still likely to flatten. In our view, against the backdrop of the broad-based decline in commodity prices, a rate selloff in the near term would mainly come from a hawkish surprise, which should negatively affect the intermediate sector more. Further, our fixed income mutual funds positioning index shows that positioning is in steepeners. The curve also does not appear too flat to us. Adjusting for the path of policy, the level of breakevens and bund yields, the 5s30s Treasury curve remains close to fair. Finally, from a vol perspective, USD 3m*30y is now roughly at par with USD 3m*5y, as opposed to having traded at a discount for most of the past two years. As a result, the trade can be initiated at roughly zero cost

US Rates: Weekly Review

Thursday, July 23, 2015 11:40 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX