Barclays notes:

Our Q2 tracking estimate fell five-tenths on the week, driven lower by data that reduced our estimates of consumption, inventories, and residential investment.

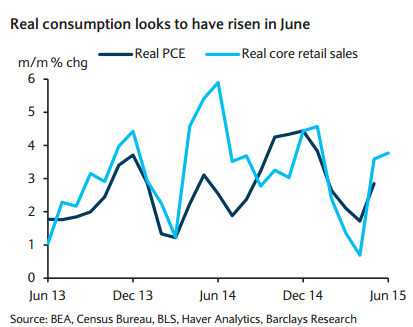

Retail sales were disappointing in June with core sales falling 0.1% m/m (forecast: +0.3%). The decline in core sales trimmed our estimate of real consumption two-tenths to 2.8%, bringing our GDP tracking estimate to 3.5%.

Retail inventories ex autos (0.1% m/m) rose less than expected in May, lowering our estimate of Q2 inventory investment. Separately, import price data for June along with our revised trade assumptions narrowed the boost to growth from net trade in Q2. Together, our GDP tracking estimate fell three-tenths to 3.2%.

The details of the June industrial production report showed stronger utility output than expected, which boosted our estimate of real consumption to 2.9%. Motor vehicle production declined a bit more than expected, however, trimming our estimate of inventory investment. On net, our tracking estimate fell one-tenth to 3.1%.

Housing starts left our tracker essentially unchanged. A small decline in core goods boosted our estimate of real consumption modestly to 2.9% and increased our Q2 GDP tracking estimate to 3.2%

US GDP tracking: Q2 3.2%

Sunday, July 19, 2015 9:45 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed