The FOMC (Federal Open Market Committee) of Federal Reserve is quite unlikely to announce an increase of interest rates in Wednesday’s meeting, according to Nordea Bank's analysis.

The Fed is currently finding itself in a highly challenging spot. Several Fed officials, a few weeks ago, were contemplating the growing possibility of an interest rate hike during the summer; however, the May employment report was quite disappointing and altered the scenario for the rate decisions for the US Fed. The central bank's chairwoman Janet Yellen, after the release of job numbers, had underlined the growing uncertainty regarding labour market.

Thus the US Fed is likely to remain sceptical in raising the rates immediately, said Nordea Bank in a research report.

Hence, the US Fed is expected to keep a wait-and-watch stance in order to examine if the weak growth in payroll in April and May was temporary or the beginning of a serious downturn. Unless the uncertainty regarding labor market is cleared, the Fed is unlikely to raise the rates, at least for now.

Meanwhile, however, the US Fed is likely to keep the door open for a hike in July or September if the income data permits. Therefore, the median FOMC fed funds rate forecast in the dot plot is expected to be the same at 0.875 percent, in line with two rate rises in 2016, added Nordea Bank. But, the median rate projections for 2017 of 1.875 percent and for 2018 of 3 percent might be revised down a tad.

The statement by the FOMC is expected to include the recent subdued employment data; however, it is also likely to acknowledge that the overall GDP growth and the consumer spending growth seem to have recovered in the second quarter.

Meanwhile, the US Fed, in its statement is expected to note that survey-based measures of longer-term inflation expectations have declined recently and market-based inflation measures of inflation compensation continue to be low.

Yellen had recently mentioned that if inflation expectations are really moving lower, “that could call into question whether inflation will move back to 2 percent as quickly as I expect”.

The FOMC is likely to make just slight alterations to its economic forecasts. The 2016 GDP growth forecast is expected to be downwardly revised a bit and the jobless rate projection should be revised down. Moreover, inflation outlook is likely to be upwardly revised for 2016. At the current stage, the Fed is likely to take some time to regain sufficient confidence to move towards tightening once again. Therefore, the Fed is expected to hike in September and December, added Nordea Bank.

But, if payroll growth rebounds sharply in June, the Fed’s next move might already take place in July. However, if there is additional information that the labor market is weakening, there might be a possibility that the Fed might give up its tightening bias in the near future, according to Nordea Bank.

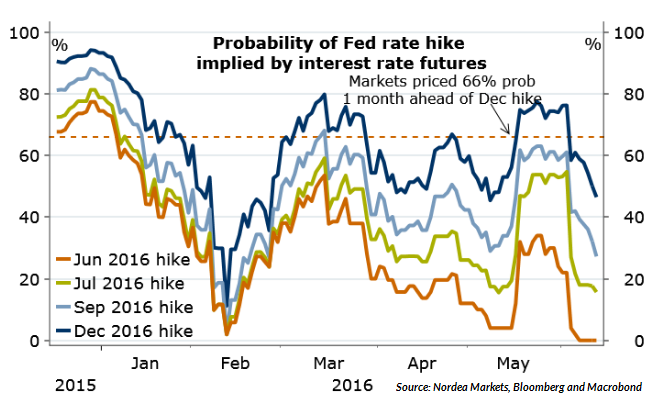

Fed funds futures indicates towards a 0 percent probability of a June hike, a 16 percent possibility for a July hike, a 27 percent chance for a September hike and a 47 percent possibility of a December hike.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022