The reported May increase in auto sales combined with a solid increase in retail sales suggest that consumer spending finally rebounded that extended into the early spring.

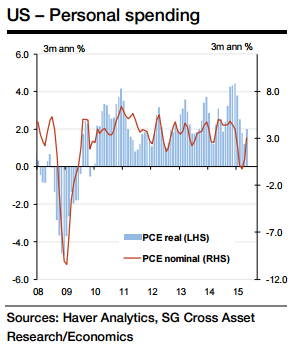

"Personal spending rose by 0.8% m/m in May, after a flat reading in April, which would mark the largest sequential gain in spending since March Q2 GDP forecast of 3.3% assumes 2.6% annualized growth in real consumer expenditures. If May projections for PCE come to fruition, this would put us well on track to meet this target", estimates Societe Generale.

Admittedly, inflation will "eat up" about half of this increase given our forecast for a 0.4% rise in the PCE deflator. The remaining 0.4% gain in real personal consumption would put the May level 2.2% above the Q1 average, significantly improving the momentum relative to the start of the quarter, added Socgen.

US Consumer spending finally on a rebound after a winter pause

Monday, June 22, 2015 6:01 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed