Today's release of Consumer price index (CPI) numbers will be most watched by traders and investors ahead of tomorrow's FOMC rate decision. CPI is scheduled to be released at 13:30 GMT. However today's CPI figure, may turn out to be a non-event for the market as FED is widely expected to hike rates.

Why important?

- FED's dual mandate is price stability and maximum employment. However, Unemployment rate has now reached 5.1% in US, which is considered as very close to long term level. That leaves inflation to be most vital for subsequent hikes.

- This is last key high profile release before FOMC decision tomorrow. So the reaction stands very crucial. Moreover it might even influence policy makers' debate.

- Moreover, inflation numbers even if don't influence tomorrow's decision on rates, it might influence over further guidance over next year.

Past trends -

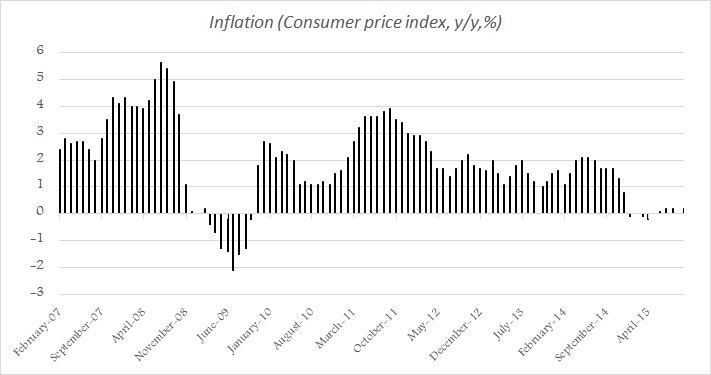

- After staying below FED's 2% target, headline CPI fell to negative territory in final quarter of 2014. In January CPI fell by -0.7% on monthly basis, mostly due to lower energy prices. Yearly CPI fell by -0.1% YoY in January.

- Yearly change in CPI has been minimal since then, growing about 0.04% per month.

- Yearly CPI growth was +0.2% in October.

- However, core CPI has been showing remarkable resilience, monthly growth not falling below since February 2010. In October, prices grew by 0.2% m/m and 1.9% from a year back.

Expectation today -

- CPI is expected to remain flat m/m and rise by 0.4% yearly basis.

- Core CPI is expected to grow at 2% on yearly basis.

Impact -

- CPI may not be a major mover today as FED hike is very much expected. Unless there are major changes both to the downside or upside major volatility is unlikely.

- However, better reading might lead to some dollar buying ahead of FOMC tomorrow.

Dollar index is currently trading at 97.53, lowest level since October.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022