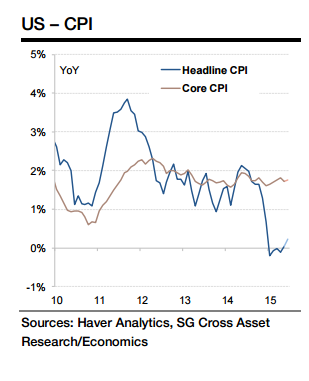

Headline inflation has undoubtedly bottomed. After a 0.4% m/m increase reported for May, a similar gain is expected in June. This time, however, the gain is expected to be more broadbased and not just driven by energy.

"We estimate that gasoline prices rose by 4.9% m/m in seasonally adjusted terms, boosting the headline by about 0.2%," says Societe Generale.

Food prices, which have been falling since January, are also likely to reverse and a 0.15% m/m gain is expected in this component of the CPI basket. Most importantly, core inflation is likely to return to a trend-like 0.2% m/m pace after a 0.1% print in May. The prior month's weakness was concentrated in used vehicle prices and in lodging, and this is not expected to be sustained. If the forecasts come to fruition, the yoy inflation rate will finally move to the positive territory for the first time since December. Core inflation should rise from 1.7% to 1.8%, meeting one of the Fed's criteria for a lift-off in rates.

US CPI to post another outsized gain, but this time more broad-based

Sunday, July 12, 2015 11:35 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX