Hawkish comments from U.S. Federal Reserve Chair Janet Yellen last Friday raised the chances for a September rate hike. Yellen struck a more optimistic note on the economy at a much-anticipated speech at an economic symposium at Jackson Hole, Wyoming. Yellen recapped the upgrades to monetary policy through the crisis of 2008 and expressed confidence that based on the strength of employment the outlook is positive for the economy building a case for a rate hike.

“I believe the case for an increase in the federal funds rate has strengthened in recent months. Of course, our decisions always depend on the degree to which incoming data continues to confirm the Committee’s outlook,” Yellen said.

It is evident from the above statements that despite the hawkish tone, the Fed’s next move remains data dependent. The fate of the September rate hike will rely on the next employment, retail sales and inflation releases. Fed vice chair Stanley Fischer told CNBC the August jobs report, due to be released on Friday, would likely weigh on the Fed's decision, along with other data that may come in before the Federal Open Market Committee's two-day meeting beginning September 20.

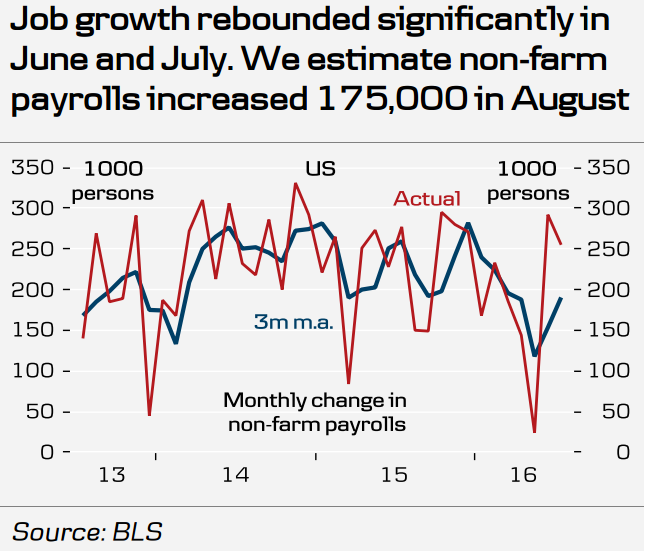

The U.S. August non-farm payrolls (NFP) report will be published on Friday, September 2 at 8:30 am EDT. In July, the U.S. economy added 255,000 jobs, while the unemployment rate was at 4.9 percent and wages increased at an annualized pace of 2.6 percent. Employment has been the strongest pillar of the U.S. economic recovery. According to a Reuters’ poll, the U.S. likely added 180,000 jobs in August. A strong report will keep the September rate hike on the table, but a disappointing report could complicate the possibility of higher rates ahead of the U.S. presidential elections in November.

"We estimate non-farm payrolls increased 175,000 in August. We expect average hourly earnings increased 0.2 percent m/m in August in line with the recent trend implying an annual growth rate of 2.5 percent. We expect the unemployment rate declined to 4.8 percent in August, but it is a close call between 4.9 percent and 4.8 percent," said Danske Bank in a report.

US dollar was buoyed across the board after hawkish comments from Yellen at the Jackson Hole symposium. The dollar index is extending gains on Monday, up 0.15 percent at 95.62 at around 10:00 GMT. USD/JPY was trading at 102.12, while EUR/USD was at 1.1182.

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target